First-Price vs Second-Price Auction | Differences Explained

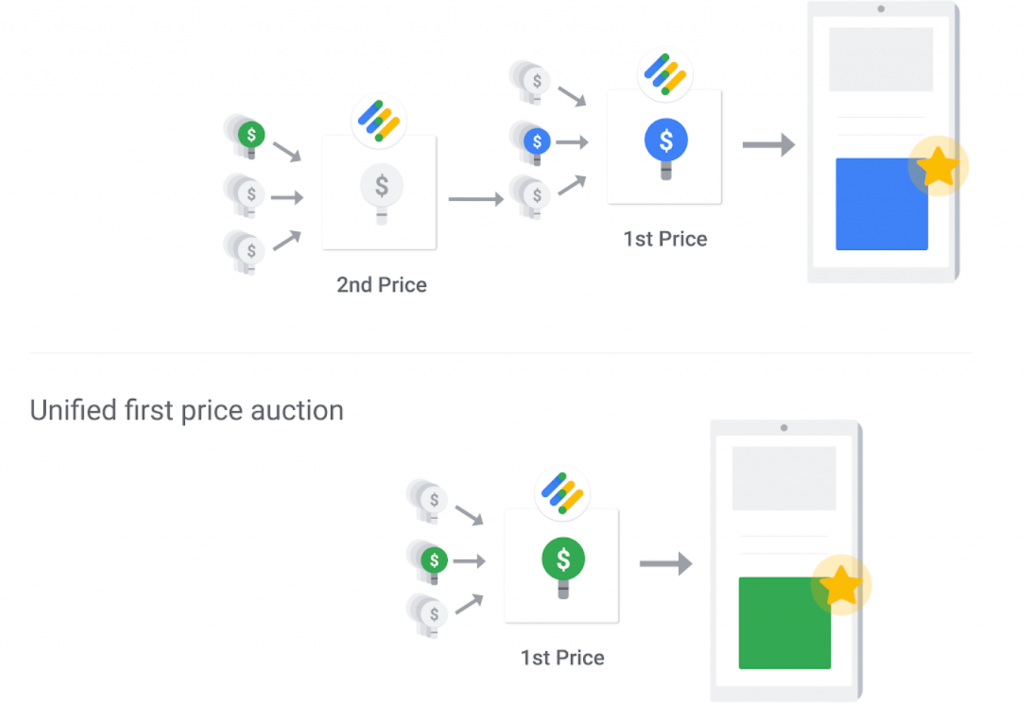

In 2019, Google has completed a transition from a second-price auction to a first-price auction model that affects display and video inventory sold through Google Ad Manager (GAM). This does not impact Google AdSense.

According to Google, this change has been influenced by many reasons. Shady buy-side tactics inside the adtech space have created an uneven playing field, while programmatic has evolved into an increasingly complex marketplace with different auction rules and stages.

The shift to the first-price auction was indeed much needed, especially with the rise of header bidding, as it was making it difficult to optimize performance in the second-price auction setting. Given the importance of programmatic advertising and RTB (real-time bidding), it’s important to understand the difference between first-price vs second-price auctions and decide which one will benefit you the most.

What is a First-Price Auction?

In programmatic advertising, the first-price auction model allows bidders to compete simultaneously, with the highest bidder taking the prize. The winner pays the exact CPM they bid during the auction, also known as the clearing price.

In programmatic advertising, the first-price auction model allows bidders to compete at the same time, with the highest bidder taking the prize. The winner pays the exact CPM they bid during the auction, also known as the clearing price.

First-price auctions generally favor publishers more than second-price auctions. In a survey by Digiday, 78% of publishers said the transition from second-price to first-price auction helped them maximize their ad revenues.

Related Article: How to Increase Ad Revenue | Success Formula and Proven Solution

In a first-price auction, publishers and advertisers can assess the true value of each 1000 ad impressions and accurately measure their ROI (Return on Investment). It also provides a clear auction outlook where bidders know how much they offer for a given inventory.

First-Price Auction Example

Three bidders participated in the auction (A, B, C). Each of the bidders set a price of how much they are going to pay for 1000 ad impressions:

- Bidder A = $3

- Bidder B= $5

- Bidder B = $4

The highest bid in this auction is 5$. Bidder B wins the auction and pays $5 per 1000 ad impressions to the publisher.

What is a Second-Price Auction?

In the second-price auction model, similar to the first-price auction, the highest bidder wins. However, the final price is not equal to his initial bid, but just 0.01$ more than the second-highest bidder’s bid.

Google AdSense was historically operated on a second-price auction model. The price paid by an advertiser–cost-per-click (CPC)–was less than the CPC they bid in the auction. However, it has shifted to the first-price auction at the end of 2021.

Second-price auction has been an industry standard for many years. However, with RTB and header bidding coming to the fore, publishers could allow multiple ad exchanges (SSPs) to bid on their inventory simultaneously. Consequently, this created a lot of complexity and operational inefficiency in second-price auctions. Moreover, second-price auctions often involve hidden fees taken by SSPs.

Second-Price Auction Example

Again, three bidders participate in the auction (A, B, C). Their bids are:

- Bidder A = 3$

- Bidder B = 5$

- Bidder C = 4$

The highest bid in this auction again is 5$. Bidder B wins the auction but will only pay 4.01$ (4$ + 0.01$) for each 1000 ad impressions.

The difference a winning bidder saved on the impression is called reduction. In this example, it amounts to 0.99$ (5$ – 4.01$).

First-Price vs Second-Price Auction

The main difference between first-price and second-price auctions is that in a second-price auction, publishers receive less ad revenue because the process reduces bids. For this reason, publishers sometimes set floor prices, which act as a threshold from which the bids are counted. Floor prices aim to increase the closing bid.

Because of inconsistencies in how different exchanges manage auctions, the first-price auction also ensures greater transparency than second-price auctions. It allows buyers in one exchange to compete more fairly with buyers from other exchanges.

Related Article: 3 Tips for Price Floor Optimization in Programmatic

Source: Google

First-Price Auction Advantages for Publishers

- Publishers earn more revenue without the bid being reduced.

- Publishers can accurately assess how much their ad inventory is worth.

- The first-price auction model eliminates unnecessary barriers and provides more transparency.

- The first-price auction works better with header bidding, allowing for simultaneous bidding and more competitive bids.

Nevertheless, the first-price auction may motivate buyers to submit lower bids to save money deliberately. This practice is known as bid shading.

Bid Shading

Bid shading is what advertisers use to win the impression at the lowest price. It takes the highest possible bid and attempts to predict the market value for a given impression. Additionally, bid shading can steal up to 20% of publishers’ ad revenue.

An effective way to fight bid shading is by setting a floor price. However, in the first-price auction, floor prices do not impact the clearing price (the final price paid for an impression), which is what floor prices traditionally have been used for. Instead, the move to first-price auctions forces publishers to reconsider how they use floor prices to protect their inventory.

Consequently, Google released unified pricing rules that aim to help publishers optimize their floor prices. In addition to concentrating on determining the true value of their inventory, it’s advised to adjust prices for different inventory segments.

What Does the Future Hold for Publishers?

Google’s shift to the first-price auction was not the first of its kind; however, it was an important step for the whole media buying and selling. Initiatives such as ads.txt and sellers.json, which were introduced to increase the transparency of the supply chain, are another example of the industry’s demand for trust and operational simplicity.

We at Setupad believe that first-price programmatic auctions provide a fairer environment for publishers to sell their inventory. We realize that the ultimate goal for buyers is to extract maximum value from every ad impression. Therefore, we strive to help publishers to receive their fair share.

Our technology increases competition, pushing demand partners to pay even higher prices for ad impressions. We continuously help publishers improve their inventory, making it more appealing for the buyers to compete for.