Google Think Partner ’22 Key Takeaways

Context

On May 25th & 26th 2022 Setupad team attended Google’s EMEA Think Partner Summit in Dublin, Ireland. It was an exciting opportunity for us as Google’s Channel Partner to discuss cross-industry trends, market insights, and the Google product roadmap.

We’re now excited to share with you key takeaways from different topics discussed at the event.

Google Analytics 4

- Universal Analytics is a current version of Google Analytics first introduced in 2012. It was built for online measurement of data across the web through the use of cookies

A new technology was needed to meet the changing needs of users in the highly privacy-regulated environment. Therefore, a new product–Google Analytics 4 (GA4)– was introduced, which operates across platforms and doesn’t rely exclusively on cookies.

- GA4 doesn’t store IP addresses, relies on conversion and behavioral modeling and has predictive analytics features to improve ROI (return on investment)

- It’s powered by first-party data and Google’s proprietary data for audiences

- It has a direct integration to Google Ad Manager (both Google Ad Manager and Google Ad Manager 360)

This data can be plugged into Setupad’s client dashboard also with the current version of Google Analytics (Universal Analytics).

- App & Web property data available in Google Ad Manager reports

- Publishers ad reports will appear in GA4

- Activating audience lists between GA4 and Google Ad Manager will also be available

Setupad Expert Opinion

Povilas Goberis, COO at Setupad: “It’s strongly recommended to migrate to GA4 as soon as possible, as Universal Analytics will be deprecated from 1 July 2023. There are also some alternatives in the market that may be used to substitute the high demand of real-time data for publishers available in Universal Analytics and lacking GA4, such as Marfeel.”

Buyside Perspective

- Performance-based campaigns and branding campaigns are increasingly more intertwined – advertisers want to have it all

- Most important KPIs for advertisers are ROI, conversions and brand-lift metrics (e.g., by how many points was the campaign able to drive the user’s awareness of the brand)

- Growing interest in video and audio inventory

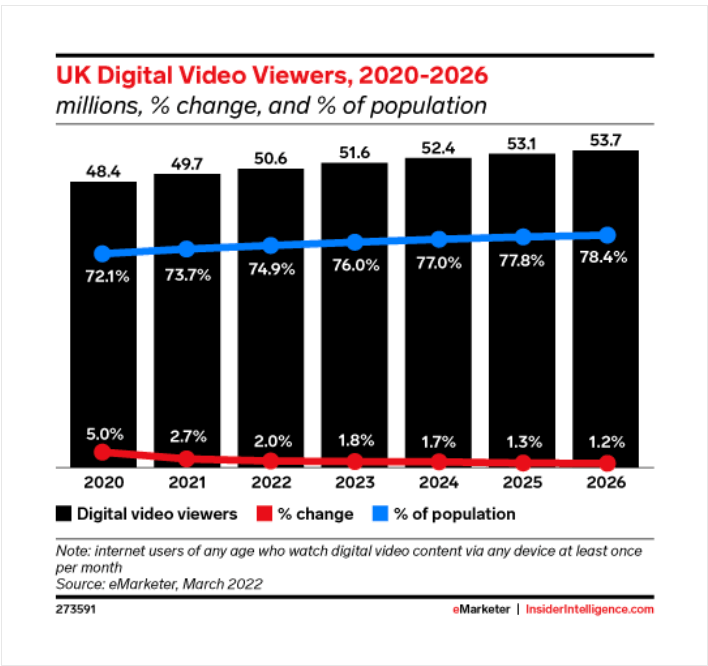

- Report shows that digital video viewer number will surpass 50 million in 2022, accounting for nearly three-quarters of the UK population

Source: eMarketer

- Growing interest in CTV (Connected TV)

- First-party data will be the most valuable resource publishers once the third-party cookies phase out

- Advertisers will be increasingly more interested in contextual advertising and utilize tools The Topics and Fledge, which are part of Google’s wider Privacy Sandbox initiative designed to serve remarketing and sustainably replace third-party cookies

Open Bidding

- Google Ad Manager product strives towards automation

- Google Ad Manager now supports customized date ranges and tentative Google Analytics integrations for remaining features

- New Top Pricing Rule Cards 2.0 dashboard visualizes bid landscape data for all winning/ losing bids across non-guaranteed demand (features include remnant bids, rejection reasons, as well enhanced usability in the UI)

- New Opportunities Framework with more experiment types and opportunities added

- Dynamic Allocation (DA) feature is now improved and allows high-value auction bids to displace direct campaigns without disrupting their delivery and maximize overall ad revenue

- A new Optimized Floors (OF) feature now takes into consideration historical advertisers’ bids and prevents missed opportunities for the publisher, ultimately setting yield-optimizing price floors while protecting long-term inventory value

- Optimized Pricing (OP) is another new feature that utilizes machine learning to increase auction floor prices and prevents advertisers from buying ad inventory for less than the its actual value

- Header bidding in yield groups is a a new Google Ad Manager 360-only feature which introduces a package of tagging, trafficking, ad server, and UI improvements to better support publishers that work with header bidding partners (like Setupad) in Google Ad Manager (read more about it here)

Policy & Spam

- The role of Google Publisher Policies is to safeguard the safety of users and advertisers, and for publishers to grow revenue while enforcing policies

- New Publisher Policy Help Center is launched. Publishers are required to keep up with policy changes and be in compliance with them at all times

- Google Publisher Policies align across all Google Publisher products (Google AdSense, AdMob, Google Ad Manager)

- Content policies refer to the content itself (e.g., site, page, app you’re showing ads on); behavioral policies refer to ad ad implementation/ad placement

- Violations generally fall into content policies and content restrictions

- Content policies means Google will not allow to monetize a specific content, e.g., illegal content, intellectual property abuse, etc.

- Content restrictions mean Google will restrict specific content, meaning you’ll see limited demand sources on monetization of this type of content (e.g., sexual content, tobacco, etc)

- Some content policies have been changed to restriction: no account termination risk, but limited demand sources

- From 2021, Confirmed Click is now applied to desktop (previously only applicable to mobile). It might be applied to web property level as a whole, domain level, or ad unit level

- It takes couple of weeks for Google to lift the Confirmed Click penalty (if no accidental clicks are detected)

- More information regarding breaches and Confirmed Click use-cases will be followed in Q3-Q4 2022

- A new enterprise-level tool Project Shield is launched to protect websites against DDoS attacks

Video

- The global volumetric video market to grow with a CAGR of 26.9% from 2021-2027

Source: Research and Markets

- Google Ad Manager now provides more insights about video inventory and key performance metrics in the new “Programmatic video signals” dashboard

The improvement of these signals is correlated with increased eCPMs, fill rate, and ad revenue (+25% increase globally).

- Components of video monetization signals include improvement of audience targeting, brand context, and video ad viewability

- Audience signals enable buyers to deliver messages to the right users at the right time. To improve them, you need to use the latest version of IMA SDK

- Brand context signals ensure brand safety and give advertisers more confidence. To improve them, you need to use ads.txt (or app-ads.txt), up-to-date SDK, and ensure that url and description_url are passed during ad requests

- To improve ad viewability signals, you need to use video player in optimal locations and make it the most prominent element of the screen to better engage your users

- Audio ad units may be defined the same as video ad units in GAM and are already available to be supplied for both programmatic deals and open market

- There is uncertainty around how audio needs to be managed, especially in the auto-play video content scenario.

While Google Chrome policy requires audio to be muted by default for video on mobile devices, TrueView video policy requires audio to be turned on for video ads. This may be partially solved by ensuring a proper user engagement with the content or the player, which organically reflects the actual need of the user–to view the content including video with a pre-roll ad.

MCM and GAM Roadmap

- Teams feature in Google Ad Manager will continue to be developed to align with MCM partners’ needs. There is currently no possibility to limit the Line Items and enable reporting for specific child account. Which is what Parent accounts that manage publishers’ inventory under the Manage Account delegation type in MCM need

- A most important update in the MCM product roadmap is the development of SupplyChain object

- SupplyChain object is an initiative that allows buyers to see all entities involved in the selling or reselling process and is complementary to the industry-wide initiatives like sellers.json and ads.txt

- Each initiative (SupplyChain object, sellers.json and ads.txt) presents buyers with a unique piece of information and enhances transparency

- In order to complete the SupplyChain, Google needs the seller-id of every Manage Inventory (MI) child publisher. Some buyers have indicated that they will pause bidding on inventories that have incomplete supply chains (SupplyChain object)

- Google Ad Manager 360 now offers video solutions feature availability (only available in Google Ad Manager 360)

- Audience Management feature allows to create audience segments based on data and insights about visitors to your websites and apps and it relies entirely on first-party data (only available in Google Ad Manager 360)

- PPID (Publisher provided identifier) is an identity solution that allows publishers to target users for monetization across any device or environment once those users have been anonymously identified with first-party data (only available in Google Ad Manager 360)

- A new feature in GAM allows to share encrypted signals with the Authorized Buyers and Open Bidding via Ad Manager. These encrypted signals will be a result of a publisher-chosen ID Provider implementation, which may not be read and used by Google

- Data Transfer Reports provides publishers with log-level data of every event in Google Ad Manager network including impressions and clicks (only available in Google Ad Manager 360)

AdSense for Platforms (AFP)

- A new product launch AdSense for Platforms (AFP). AFP is a customizable enterprise-level product designed to give content platforms, CMS, and site building solutions the opportunity to natively integrate ad monetization across their solutions

- The main feature of AFP is to allow content providers to participate in a marketplace-like ecosystem provided by a platform, where the main commodity is the content, which can be monetized by Google and revenue split transparently between the creator and the platform

- Content creators would be required to register for their own Google AdSense account and the same content policy would apply for them as for any regular AdSense user

Emerging Ad Formats

- A report has found that the video games industry is expected to exceed $200 billion in value in 2023

- There are 2.65B mobile gamers globally in 2021 with a 55% to 45% M | F gender split

- Advergaming (a form of advertising in video games in which the video game is developed for purposes of advertising a brand-name product) is now more popular than ever

- InPlay Ads are a new ad format that blend with the natural gaming experience and rendered in the natural environment of the game

- This ad format is unique doesn’t compete with any other ad formats, therefore it’s going to bring a lot of ad revenue for game publishers moving forward

- H5 games is a new ad format that is distributed in web and app (webview) and is seen as a new type of content which will improve user engagement and bring an additional revenue stream to game publishers

- Web interstitials and rewarded web ads are ad formats that are also gaining big traction in adtech

- Full screen native ad is another emerging ad format that enables publishers to display highly engaging ads that match the look and feel of their app

Web Apps

- On mobile devices, people spend 87% of their time in apps versus 13% in browsers of which 77% they spend time in top 3 apps installed on their devices

- Users spend over 60% of the time on the entertainment and communication apps, while reading the content takes a mere 2% of users’ time

- The app market is highly competitive and concentrated

- Having a website while marketing an app is highly recommended because it may drive additional awareness and operate as loyalty-building platform which is necessary for the app’s success (will the app stay installed on users’ phones)

- If a publisher wants to build an app, he needs to perform a self-assessment to understand if there is a strong recognition for his brand and a good referral traffic

- In certain situations PWA apps may be a better choice than native apps, as their weight in megabytes is much lower. It’s especially important for markets where low-storage mobile devices prevail, e.g., India

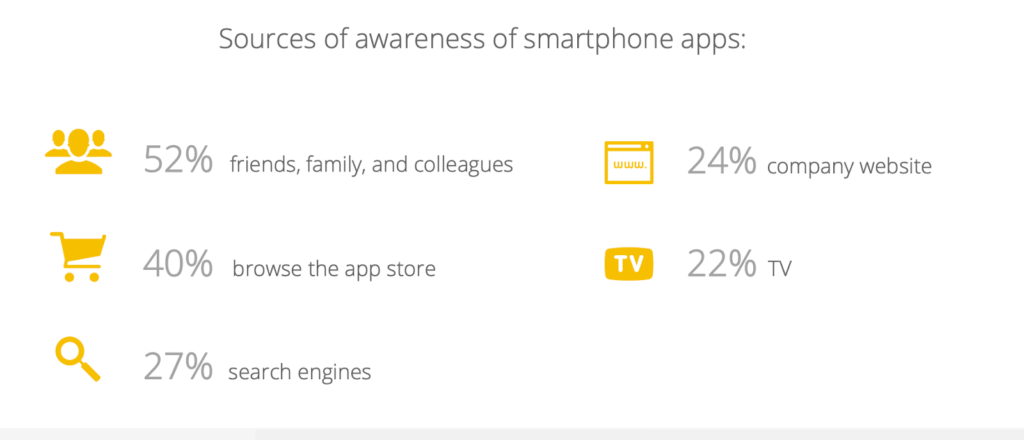

- Source of awareness for apps differ

Source: Thinkwithgoogle

How do you choose which app to build?

| App Type | What Is It? | Benefits | Disadvantages |

| PWA (Progressive Web Apps) | Website that adops app-like behavior (more information about PWAs) | • ‘Add to Home’ button • Increased engagement with website’s most loyal users • Cost-effective | • Low install rate • No Play Store visibility |

| TWA (Trusted Web Activities) | Technology that turns your PWA into Android app | • One codebase that works across web and app • Cost-effective • Access to Play Store new users • Web Format monetization • Particularly valuable for low-storage phones | • Need to go through Google Play approval • Need to follow requirements for a PWA in Play Store |

| Flutter or React-Native | Open source Native-based frameworks to develop and deploy apps across many platforms | • One codebase across web and apps from different OS • Good support and active dev community • Relatively fast to build | • Requires full-scale development • Dependent on plugins for monetization |

| Native app | A native app designed for a specific OS (e.g., iOS/Android) | • AdMob monetization • Engaging look and feel • Google Play and App Store presence | • Costly • Requires platform-specific language knowledge • iOS and Play Store approvals • No web discoverability |