The Ultimate Guide to CTV Monetization in 2024

CTV empowers publishers with ad monetization solutions and helps them gain maximum revenue.

Advertising on CTVs offers the ease of tailored, skippable ads that can be served to target audiences on their TVs and streaming devices. But simply relying on the programmatic approach isn’t enough for sustainable CTV ad monetization. The same is true in the case of optimizing ad tech stacks to deliver maximum returns on CTV ad inventory.

In this blog post, we’ll explain what CTV ads are, tips on the successful CTV monetization strategy, and the most popular CTV monetization models for publishers.

What Is Connected TV (CTV)?

Connected TV (CTV) refers to any television set that can connect to the internet to stream video content, whether through built-in or external devices (e.g., gaming consoles.)

This technology has revolutionized the way we consume television, giving rise to the “cord-cutting” trend where viewers move away from traditional cable subscriptions, opting instead for on-demand streaming platforms.

The flexibility of CTV enables a more personalized viewing experience, from binge-watching favorite shows to tailoring content consumption around individual schedules.

What are CTV Ads?

Connected TV (CTV) ads are played with video content and accessed through internet-connected devices, large-format TV screens, and apps.

Examples of CTV advertising include ads that are shown on TV shows, or live-stream shows that are viewed on streaming devices. Interactive ads are also CTV ads, which are displayed to a specific audience and allow viewers to take action. In addition to the categories of CTV video ads, it includes online video ads or in-stream ads, which run within video content on websites.

Likewise, Connected TV ad traffic can be measured and attributed through impression logs associated with viewers or households through identity resolution systems. In other words, if a user X watches a CTV ad for a pair of shoes on the Smart TV and then later makes a purchase from that brand on a mobile phone, attribution models can identify that the Smart TV and mobile phone belong to the same user X user who just saw that ad.

The CTV environment has a lot of great things to offer to publishers. Different CTV monetization models and strategies are there to suit publishers’ various preferences and help them get the best results.

What is CTV Advertising?

CTV advertising relates to video ads delivered through streaming services, which are viewed on a TV set (either directly on a smart TV or via connected devices.)

Connected TV represents a large segment of the streaming market. In May 2023, there was a 21% rise in CTV viewing compared to the same month in 2022.

However, it’s essential to understand that when we talk about CTV, we are specifically referring to content that is streamed and watched on a television set, as opposed to other devices like smartphones or tablets.

What’s OTT advertising?

OTT advertising refers to the method of delivering promotional content directly to viewers via internet-based streaming services and devices, bypassing traditional cable or satellite TV platforms.

Unlike conventional TV advertising, OTT advertising enables precise targeting of specific audience segments, leveraging the advanced capabilities of digital marketing. This means advertisers can reach viewers not just on their TVs, but on a variety of internet-connected devices including mobile phones, tablets, desktops, and laptops.

CTV and OTT advertising comparison

CTV and OTT advertising might seem similar, but there’s a distinct difference.

CTV advertising specifically refers to video ads delivered through streaming devices and viewed on a television set, whether directly through a smart TV or via connected devices.

On the other hand, OTT advertising encompasses a broader spectrum, covering all streaming content across various devices, including smartphones, tablets, and laptops.

While OTT is the method of delivering video content, CTV is the device used to consume the content.

For publishers, this means that while CTV offers a more focused approach to targeting TV viewers, OTT provides a more extensive reach, capturing audiences across multiple digital touchpoints.

What’s linear TV advertising?

Linear TV refers to the traditional television system where viewers watch scheduled programs on their original broadcast channels, as opposed to on-demand streaming. The term “linear” denotes the predetermined lineup of shows, emphasizing the scheduled nature of the content.

Linear TV advertising involves the insertion of commercials or other video content into these scheduled programs. This form of advertising remains popular due to its ability to reach a broad audience, including those less active on digital platforms.

CTV and linear TV advertising comparison

Linear TV represents the old method of watching scheduled TV programs on their original broadcast channels. Ads in this space are broadcasted to all program viewers without the granularity of targeting.

CTV advertising, in contrast, is the modern counterpart, delivering ads via streaming platforms on TV sets. The key advantage of CTV is its ability to provide a more tailored advertising experience.

What’s addressable TV advertising?

Addressable TV is a modern evolution in television advertising that allows brands to target specific households with customized ads, regardless of the content they’re watching.

Unlike linear TV advertising, which broadcasts the same ad to all viewers of a program, addressable TV advertising uses advanced data analytics and digital technology to segment audiences based on factors like demographics, behavior, and location.

This means that different households can see different ads even if they’re watching the same show. By delivering more relevant and personalized ads to each viewer, addressable TV enhances the efficiency and impact of ad campaigns.

CTV and addressable advertising comparison

CTV and Addressable TV advertising both aim to deliver more personalized ad experiences to viewers, but their methods differ.

Addressable TV advertising operates within the traditional TV framework. It allows advertisers to serve different ads to households watching the same program, using sophisticated data analytics to segment audiences based on demographics and behavior.

CTV is about leveraging the power of streaming, while addressable TV is about refining the traditional TV ad experience.

Highlighting the benefits of CTV advertising

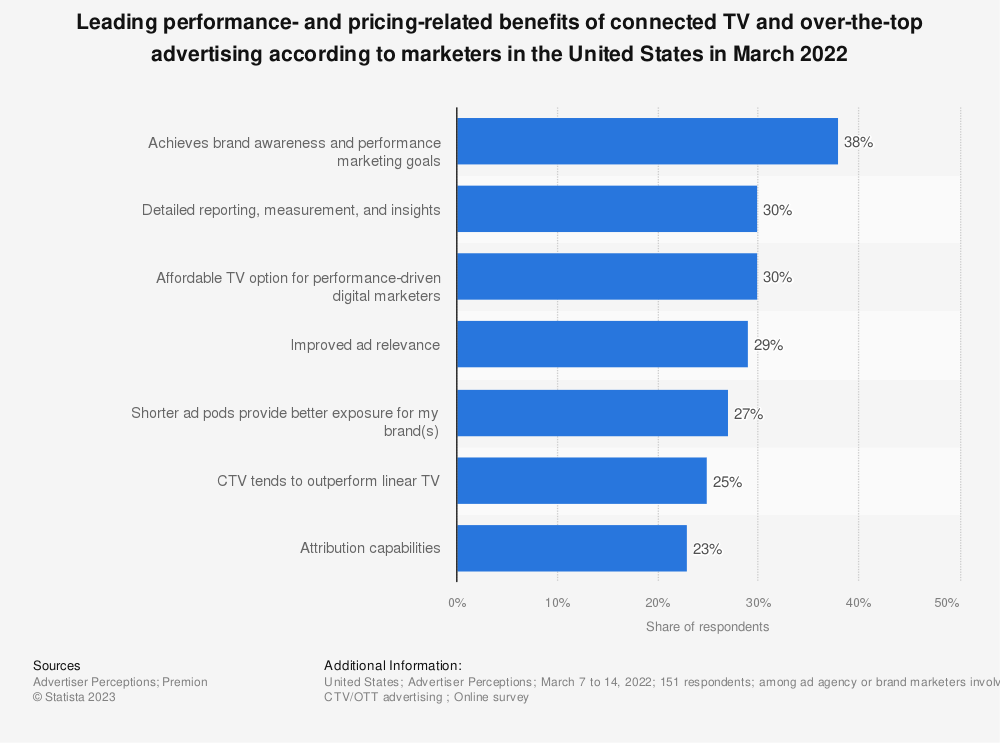

According to a study from 2022, achieving brand awareness and performance marketing goals is the leading advantage of CTV and OTT advertising for U.S. marketers. It’s followed by detailed reporting, measurement and insights.

Source: Statista

How CTV Advertising Works?

CTV advertising is a dynamic method that allows advertisers to display their ads to viewers as they stream movies, TV shows, and other video content on their connected TV sets.

CTV streaming and ad delivery

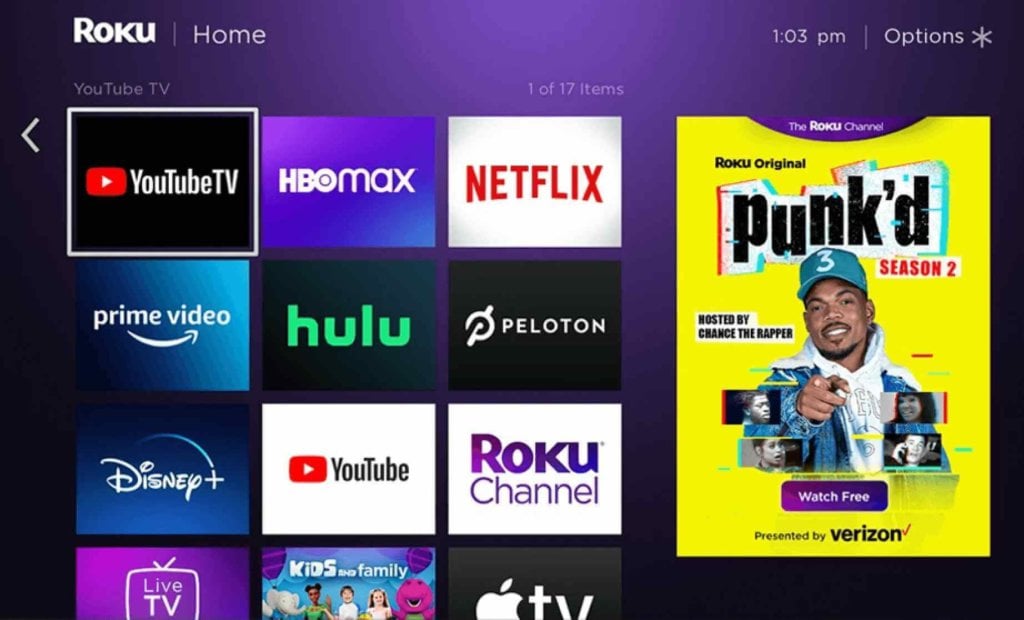

Platforms like Hulu, Netflix and Disney+ with ad-supported content serve as the mediums for these ads. These ads can be viewed on various devices, from smart TVs to streaming devices like Roku and Amazon Fire TV Stick.

The role of data and targeting in CTV advertising

What sets CTV advertising apart is its advanced targeting capabilities. Advertisers can utilize first-party data, such as website traffic or CRM email lists, to retarget viewers with tailored ads on their TV screens.

Additionally, third-party data sources enable segmentation based on demographics, interests, and other attributes. IP targeting allows for household-specific ad delivery, bypassing traditional cookie-based methods.

CTV ad formats and placement options

Here’s a list of the 3 most common CTV ad placement options:

1. Display ads (home screen ads)

CTV display ads are a form of advertising tailored explicitly for the streaming environment. Publishers typically access and integrate these ads into their content through display ad networks.

Unlike traditional video ads that play between content segments, CTV display ads often appear as text-based or visual banners on the home page of a streaming service or within the content stream.

A common format is the overlay ad, which is displayed at the bottom of the screen during streaming. These ads are designed to be adaptable, allowing advertisers to strike a balance between being noticeable without being overly intrusive.

Their primary goal is to raise brand awareness, and they can be interactive, directing viewers to specific landing pages, contact forms, or other destinations.

Source: Roku Advertising

2. Instream video ads

CTV instream video ads are similar to traditional TV commercials but tailored to the streaming environment.

These ads are prominently displayed before (pre-roll), during (mid-roll), or after (post-roll) a streamed video, capturing the viewer’s attention by occupying the entire screen.

Typically ranging between 15 to 30 seconds in duration, instream ads can be designed with varying levels of interactivity, from being immediately skippable to requiring a specific watch time before skipping or being entirely unskippable.

Due to their prominent placement and immersive nature, instream video ads are among the most effective ad formats in the CTV space, making them a top choice for advertisers looking to monetize CTV content.

3. Interactive video ads

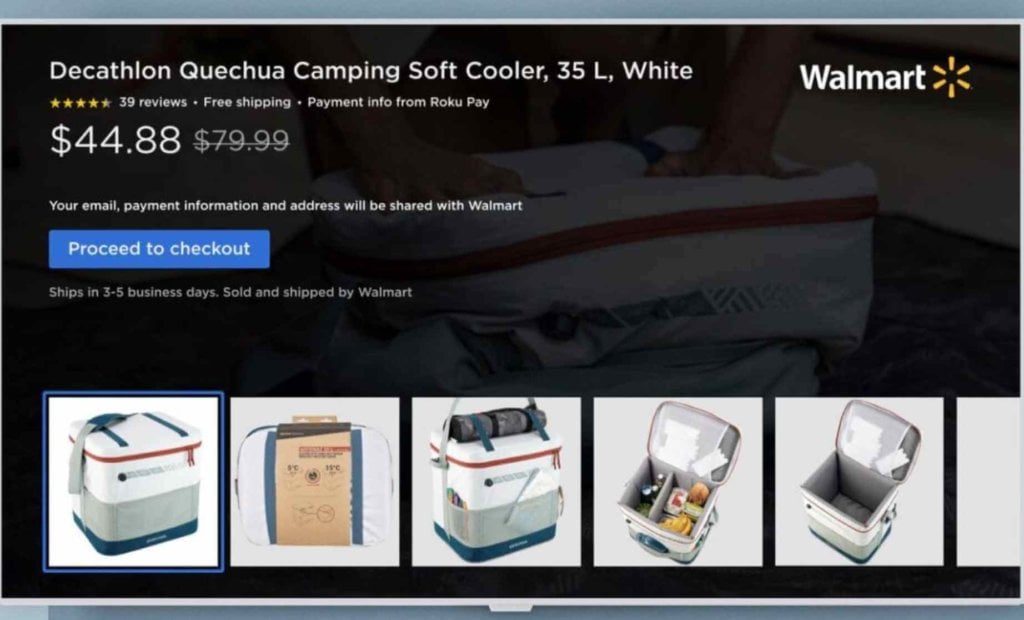

Interactive CTV ads elevate the traditional advertising experience by allowing viewers to engage directly with the content on their connected TV screens. Interactive ads invite the audience to take specific actions, such as clicking on a product for more information, participating in a poll, or even making a purchase directly from the ad.

By incorporating elements of interactivity, these ads not only capture and maintain viewer attention more effectively but also provide advertisers with valuable real-time feedback and data on user engagement. The immersive nature of interactive CTV ads offers brands a unique opportunity to create a deeper connection with their audience, driving both brand recall and conversion.

Source: KORTX

Will CTV Ads Thrive in 2024?

Yes, CTV will definitely thrive in 2024.

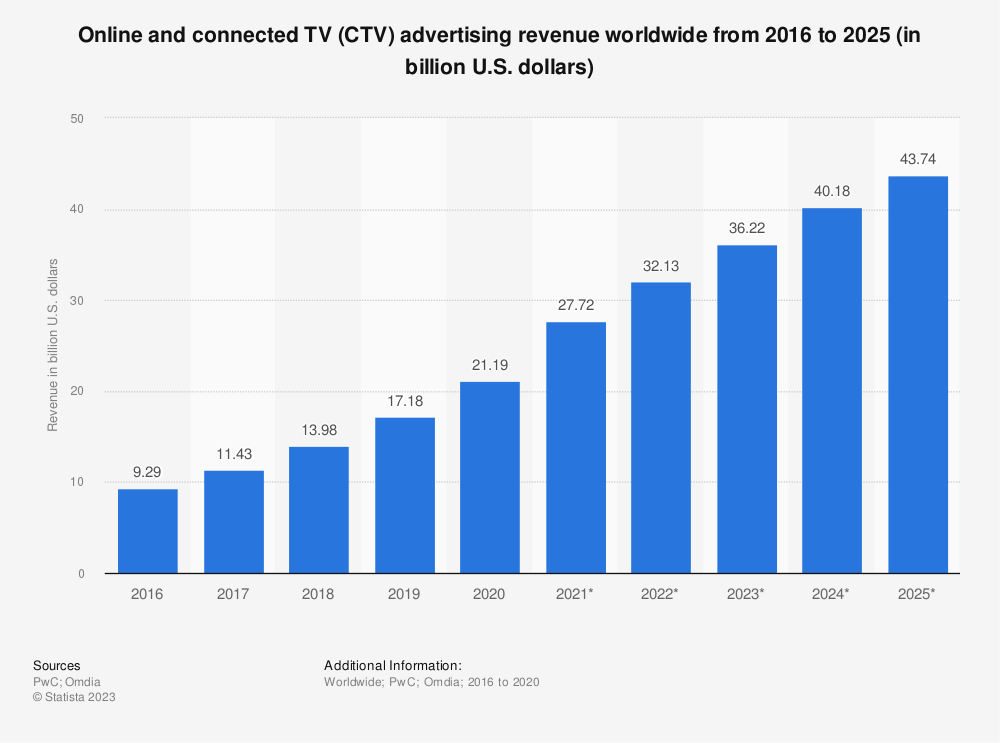

CTV advertising spend is expected to reach 43.74 billion U.S. dollars by the end of 2025.

While the consequences of recession and economic downturn are profound in 2024, for CTV publishers, it won’t be as scary as initially reported. It will ultimately drive innovation and ensure high ROI gains for publishers’ investments. According to the IAB Buyers Survey, CTV in 2024 is poised to capture the most significant share of ad spend (22.4%).

Ultimately, CTV is one of the fastest-growing advertising platforms accountable for multiple news and digital content sources.

What are the Benefits of CTV Advertising for Publishers?

CTV helps publishers get better revenue gains and monetization returns. Let’s look at the key opportunities and benefits of CTV ads for publishers.

Allows Leveraging First-Party Data

First-party data is considered the best source of information collected directly from the publishers’ and advertisers’ sources. When it comes to CTV ads, publishers can leverage first-party data to have insight into viewers’ preferences regarding:

- What type of content do they watch

- When do they watch

- How frequently are they watching this content

With insight into user preferences and behaviors, publishers can streamline the ad-buying process for advertisers. Usually, this data would come in the form of device IDs from ad servers and deal IDs from advertisers.

Advertising Demand

CTV ads also offer flexibility regarding the cost-per-view metric making it more affordable to reach target audiences on the big screen.

With the recent advancement in streaming devices, such as Roku, Amazon Fire TV, HBO Max, Apple TV, and Hulu, the connected TV has grown multifold in popularity. CTV viewership is growing rapidly, opening up new opportunities for publishers to maximize the ROI in an impactful way.

Ads are Served through Programmatic Auction

The Connected TV ads ecosystem is still evolving, which is why lots of publishers are using a programmatic approach to secure demand. A unified programmatic auction is a good start. But publishers also need to leverage OpenRTB demand optimization for CTV ads to maximize ad fill rate and revenue numbers further.

In addition, CTV ads allow publishers to open ad inventory on multiple ad exchanges. It eliminates the need to participate in a direct deal through an ad server, further boosting ad yield.

8 key advantages of CTV advertising for publishers

Here’s a list of 8 main benefits of CTV advertising for publishers:

- More precise targeting. Traditional TV advertising usually targets programs with the assumption that specific demographics are watching. In contrast, CTV enables ads to be directed at specific viewer profiles, leading to more meaningful engagements.

- Rich data analytics. CTV provides in-depth analytics on who viewed the ads, for how long, and how they interacted with them. Publishers can asses the performance of their campaigns in real-time, understand their ROI more precisely, and make data-driven decisions for future campaigns.

- Flexibility. Ads on CTV can be changed or updated on the fly without the rigidity of traditional TV slots. This adaptability means advertisers can adjust their messaging based on real-time events, viewer feedback, or analytics.

- Cost efficiency. CTV advertising often employs programmatic buying and real-time bidding, which allows for automated, efficient purchasing of ad slots.

- Broader reach. CTV ads can be served to cord-cutters (those who’ve abandoned traditional cable) and cord-nevers (those who’ve never used traditional cable). As traditional TV viewership declines, CTV provides a platform to reach a growing audience that’s increasingly moving to streaming and on-demand services.

- Interactive ads. Some CTV platforms allow for ads that viewers can click on, engage with, or even purchase directly from. Interactive ads can lead to immediate conversions and make the ad experience more engaging, potentially leading to better brand recall.

- Enhanced viewer experience. By serving relevant ads based on viewer profiles, there’s a higher chance that viewers will find the ads appealing or relevant, reducing the likelihood of them skipping the ad. A positive ad experience can lead to better brand perception and increased viewer retention.

- Digital integration. CTV advertising can seamlessly integrate with other digital marketing efforts, such as social media campaigns, email marketing, and more. This allows for a cohesive marketing strategy where messages and campaigns are synchronized across multiple platforms, enhancing the overall impact of advertising efforts.

What are the Benefits of Connected TV Ads for Advertisers?

Here are a few of the benefits of CTV ads for advertisers:

Advanced Contextual Targeting

CTV contextual targeting plays an implicit role in ad targeting by using genre. It relies on primary contextual segments to help advertisers target the relevant content based on the genres, seasonal segments, and featured topic segments.

For example, an episode of a series on Netflix gets approved for a laptop bag commercial because it is based on a corporate drama. The CTV ads depend on the ad’s relevance within the context it appears.

Real-time Measurement of Ad Campaign Performance

CTV ads help advertisers with better visibility and campaign exposure. They also allow determining the number of unique viewers from the total number of viewers. It also adds up to the number of times the ad has been shown on a smart TV or mobile phone.

Viewability is also an essential factor responsible for the success of an ad campaign. With CTV ads, advertisers can determine ad viewability based on the total number of impressions and the number of viewable impressions, as well as track viewer conversion rate and ad campaign performance in real-time.

Automated Access to Premium Ad Inventory

Online video streaming platforms such as Netflix, Amazon, Hotstar, YouTube TV, and Disney+ offer ad-supported content; hence the demand for CTV advertising inventory is extensive.

These ads provide an opportunity for better audience targeting and measurement capabilities. Besides, advertisers benefit from these vast offerings through media buying approaches, allowing them to scale and create custom deals through private and premium auction inventory.

Automated Ad-Serving For Seamless Processing of Ads

76% of ad buyers consider CTV a “must to include” in their branding budgets. According to a recent industry update, Publica CTV ad server enables audience extension strategies without including any buyer and seller. This means the advertiser working with Publica can access many buyers and sellers through a single access point enabled within the Publica UI.

Moreover, ad serving is easy with CTV ads as it allows users to decide which ads can be delivered to a particular user in the entire chain. Ad servers allow handling ad breaks and also play a role in audience targeting and processing programmatic ad placements within the pods.

What CTV Monetization Strategies Look Like in 2024?

Building an effective CTV monetization strategy is vital to growing your revenue stream. Let’s look at CTV monetization strategies and discuss the potential impact on revenue growth and engagement.

Ad Podding for an Efficient CTV Monetization

Ad pods are groups of ads that can have multiple slots and increase ad relevance because of the more advertising space. It allows publishers to offer a better user experience. Ad pods also allow bidding on more than one slot per pod.

It gives publishers a better chance for higher bidding efficiency. Ad podding can quickly drive the overall RPM and give more flexibility in managing ad length.

As mentioned, ad pods give publishers a better revenue optimization opportunity. You can also choose the length of the entire pod and determine how many ads you can serve based on your users’ preferences. Another benefit of ad pods is that publishers never get duplicate ads as it considers the entire pod.

CTV Ad Tech Stack for Monetization

For publishers, ad servers should be the main part of their tech stack. It decides which ad will be delivered to a particular user on the sell-side platform for connected TV advertising. Hence, the ad server role is the most crucial in the CTV monetization space. Ad servers handle audience targeting, programmatic ad placement, and ad breaks on pods.

Another crucial function of the ad server is allowing publishers to channel their direct-sold campaigns. Publishers can also set separate rules for competitive ad campaigns, ensuring the same ads won’t appear alongside the ads of competitors’ brands.

A New Monetization Opportunity via Programmatic Auction

Header bidding technology and CTV are now among the most desirable ways to monetize ad inventory for many players in the ad tech industry.

Programmatic auction ensures new opportunities for publishers to achieve considerable benefits in their CTV ad monetization strategy. For example, header bidding allows advertisers to bid on any inventory. And publishers will no longer have to wait for an opportunity to get higher revenue.

Publica’s CEO, Ben Antier, recently shared how programmatic advertising has adapted to the CTV ecosystem. And they are also allowing publishers to maximize their revenue with header bidding, programmatic ads, and unified auctions.

“Header bidding has worked incredibly well in the display, bringing significant uplift and CPM on the display web ecosystem, and can generate at least 30% of revenue uplift on a baseline of revenue and CPMs that are quite high.”–Ben Antier, CEO of Publica.

However, for many publishers, direct deals are the preferred way to monetize their CTV inventory because of the direct relationships with buyers. But as programmatic header bidding entered the CTV environment, this has been increasing the revenue profitability across mobile and other channels.

CTV Ad Monetization Models – A Must-Know for Publishers

CTV ad monetization models enable publishers to build, manage, and grow their ad revenue, so they can succeed more in the advertising space. There are 4 primary CTV monetization models that publishers should be aware of:

1. Subscription Video on Demand (SVOD)

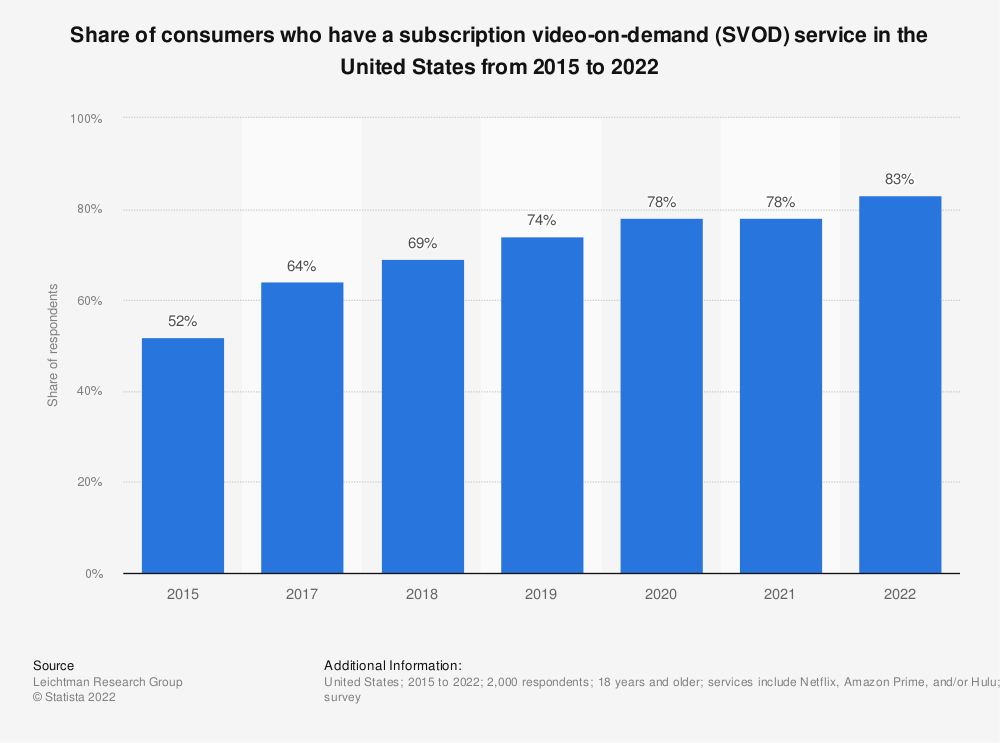

Subscription video-on-demand streaming services are based on a subscription fee. For example, Netflix and Amazon provide various ad monetization options to broadcasters for their video content. The subscription-based video-on-demand accounted for 83% of US-based consumers in 2022.

To utilize SVOD, you need to have an extensive content library based and constantly adapt your offerings based on user behavior. SVOD monetization depends on the changes in customer expectations around subscription models. Media companies that do not provide different subscription options risk alienating customers. For example, many viewers today are more willing to watch streaming media ads today rather than pay for content.

2. Advertising-Based Video on Demand (AVOD)

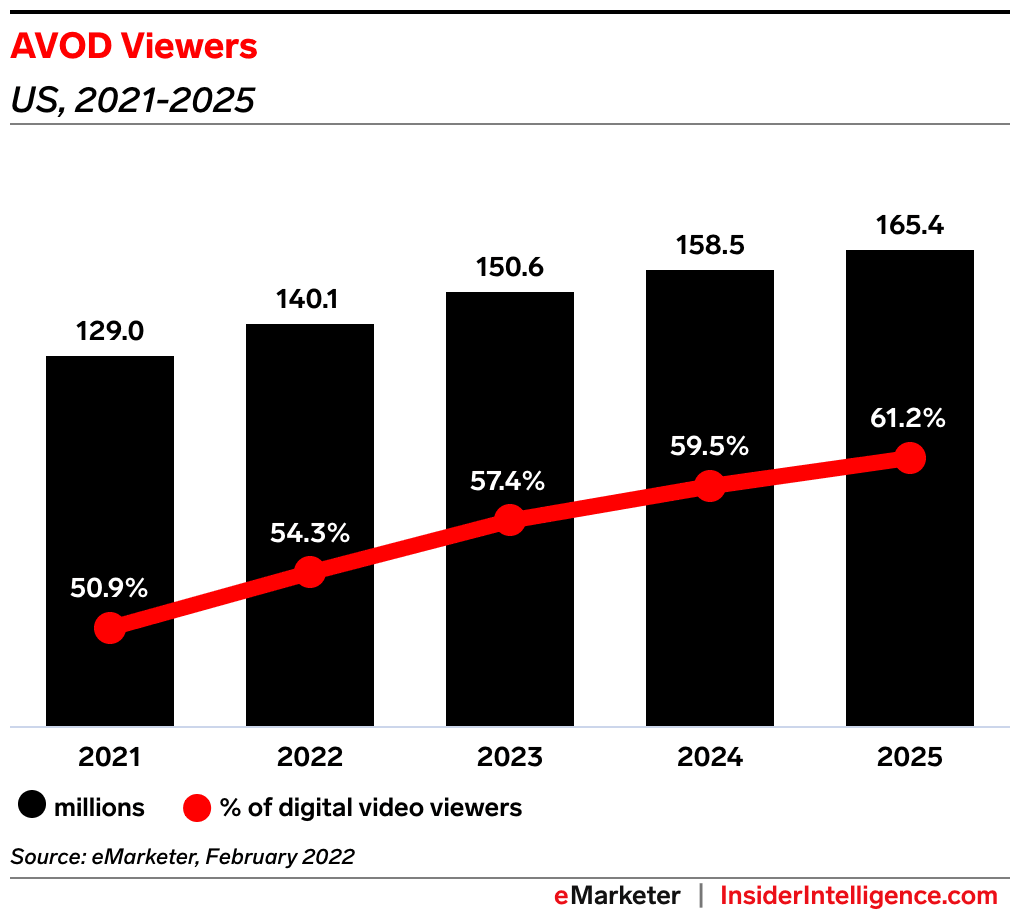

AVODs offer content through platforms like Hulu and Peacock. It also comes with specialized offerings on platforms like Samsung and Roku. However, similar content is also provided in the SVOD model but with ads. Unlike SVOD services, AVOD is free to consumers and generates lower revenue than SVOD and TVOD.

AVOD represents an opportunity to reach a wider audience. In fact, US AVOD viewers will reach 165 million in 2025.

AVOD monetization model uses the mid-roll, pre-roll, banner, sponsored, paid, and post-roll ads in the video content. Instead of relying on recurring subscription fees, publishers could utilize the AVOD model.

3. Transactional Video on Demand (TVOD)

TVOD or Transactional Video on Demand allows users to purchase or rent videos on a pay-per-view basis. There are two categories where consumers can access a piece of content for a limited time and a smaller fee.

The first one is electronic sell-through (EST), which allows you to pay once to access a piece of content. The other one is download to rent (DTR), which enables consumers to buy or rent content for a limited time and a smaller fee.

TVOD services offer access to more recent and exclusive content which cannot be found elsewhere. It helps retain customers with attractive incentives. Examples of TVOD services are Amazon’s video store and Apple’s iTunes.

4. Hybrid Model

The hybrid model leverages the features of both SVOD and AVOD platforms. For example, YouTube is a platform where users can access free content like AVOD. However, YouTube Premium also charges a fee for access to special features such as ad-free viewing, video playing even when a user’s device is locked, and ease of downloading videos for offline viewing.

Another hybrid monetization model is based on charging a fee for an ad-free subscription.

Among these four CTV monetization models, the publisher should consider one based on the type of content they create. The best model can be chosen based on the content creation budget and content publishing frequency.

Additionally, the platform supporting high-quality content and driving engagement should be considered when deciding on a CTV monetization model. Once a publisher has settled on a monetization model, they can choose the best ad monetization strategy that suits their objectives.

Implementing a Successful CTV Advertising Strategy

To implement a CTV ad campaign there are 6 main steps:

- Select a platform.

- Upload the creative content.

- Define the target audience.

- Choose ad placements.

- Set a budget.

- Launch the campaign.

Afterward, as for any ad campaign–continuous optimization based on performance metrics ensures the campaign’s effectiveness and relevance to the audience.

For a successful CTV advertising campaign, it’s crucial to harness the platform’s unique capabilities. Here are 5 tips to improve your CTV ad campaign:

- Use QR codes. Integrate dynamically generated QR codes into your ads, allowing viewers to instantly engage with your brand using their smartphones.

- Include CTV in your multichannel strategy. Incorporate CTV into an omnichannel strategy, utilizing data from other channels to refine your targeting and reach.

- Create a unique story for your campaign. Craft a compelling narrative for your campaign, ensuring it resonates with your audience and captures their attention within the first few seconds.

- Make it interactive. Make your ads actionable with clear CTAs, and consider personalizing them based on viewer demographics or location.

- Use audio to your advantage. Unlike other digital platforms where ads might be muted, CTV ads are always heard. Use this to your benefit by layering dialogues, sound effects, and music to create a memorable auditory experience that complements your visual message.

Overcoming Challenges in CTV Advertising for Publishers

One of the biggest issues in CTV advertising is lack of user engagement and interactions. The nature of TV watching has traditionally been about relaxing to a favorite show or movie. This method of entertainment hasn’t offered much interaction in the past.

Cross-platform user identification and data fragmentation are also two significant challenges in the CTV advertising landscape, as well as ad fraud and maintaining a good user experience.

Cross-platform user identification

A single user often accesses content across various devices (e.g., smartphones, tablets, smart TVs) and platforms (e.g., Roku, Apple TV, Amazon Fire TV). Identifying and tracking a user’s journey across these touchpoints is complex.

Additionally, devices like smart TVs are typically shared among household members. This makes it challenging to pinpoint individual user behaviors and preferences.

There’s also a lack of universal identifiers.

Unlike the web environment, where cookies serve as cross-platform identifiers, CTV lacks a universal method to consistently identify users across platforms. While IP addresses are sometimes used, they aren’t reliable indicators of individual users, especially in households with multiple devices.

Data fragmentation across streaming services

Each streaming service (e.g., Netflix, Hulu, Disney+) has its own set of user data, often stored and formatted differently. This leads to fragmented and siloed data pools. Different platforms might use varying metrics or definitions for similar measurements, making comparisons difficult.

Adding to that, a single user might subscribe to multiple streaming services. If advertisers collect data from all these platforms without proper deduplication methods, they might repeatedly target the same users, leading to ad fatigue and wasted ad spend.

As CTV grows in popularity, more intermediaries and data sellers are entering the market. This can further fragment data and introduce discrepancies, especially if these parties don’t adhere to standardized data collection and reporting practices.

Ad fraud and viewability concerns

Ad fraud in the connected TV landscape is a growing concern as the platform’s popularity and ad spending surge. As CTV advertising investments rise, with projections indicating significant growth in the coming years, vulnerabilities in the system are being exploited by fraudsters.

This fraud primarily stems from the platform’s nascent state, with industry standards and regulations still developing. Fraudsters employ tactics like impersonating CTV devices, generating fake impressions, and spoofing user behaviors to siphon off advertising budgets.

Such fraudulent activities not only result in financial losses but also skew performance metrics and undermine the credibility of CTV advertising.

Balancing ad frequency and user experience

Frequency stands for how often an ad is displayed to a specific user in a particular time frame. It’s one of the ways how you can ensure that users won’t get tired of seeing content repeatedly.

Frequency capping enables you to get more viewers and distribute your budget more evenly, as well as it brings a more diverse delivery of ads.

Challenges for advertisers

A survey shows that from the advertiser perspective, there are 4 main obstacles preventing spending on CTV ads in the U.S.:

- Macroeconomic headwinds. This refers to broader economic factors or challenges that might be affecting the industry or the economy as a whole. Such factors could include economic downturns, recessions, or other financial uncertainties that make advertisers hesitant to invest in newer advertising platforms like CTV.

- Too expensive (CPMs are high.) If CPMs are high, it means that the cost to reach a thousand viewers on CTV platforms is considered expensive compared to other advertising mediums.

- Lack of budget. Some advertisers might not have enough funds allocated for CTV advertising. This could be due to various reasons, such as other marketing priorities, financial constraints, or a conservative approach to trying newer advertising platforms.

- Inability to prove ROI/ROAS. If advertisers find it challenging to measure or demonstrate the effectiveness of their CTV ad campaigns in terms of returns, they might be hesitant to invest more in this medium. The inability to quantify the success of an ad campaign can be a significant deterrent for many advertisers.

Emerging Trends in CTV Advertising

As viewers increasingly engage with content on their TVs, they use various devices like remotes, game controllers, and even smartphones to interact. Modern CTV platforms offer several interactive features:

- QR codes that can turn ads into shoppable experiences.

- Viewers can use their remotes to choose which ads they’d like to watch or to delve deeper into content.

- They can also signal preferences, such as skipping intros or moving to the next episode.

In 2024, CTV advertising is experiencing significant shifts. One major trend is the move towards cookieless advertising, driven by growing privacy concerns and the phasing out of third-party cookies.

Brands seek privacy-compliant data collection strategies, emphasizing first-party data and household-focused targeting.

With the decline of third-party cookies, there’s a rising trend toward contextual targeting in CTV platforms. This approach offers brands a privacy-compliant method to enhance their audience targeting, ensuring it’s both practical and aligned with their brand values.

Another notable trend is the demand for more measurable metrics in CTV advertising. While traditional metrics like impressions and ad completion rates remain relevant, there’s a push for more comprehensive metrics that offer a holistic view of campaign impact.

The challenge, however, lies in consistently capturing these metrics amidst the complexities of cross-platform attribution, diverse user behaviors, and the ever-present concerns of data privacy. This holistic approach to metrics is crucial for advertisers to optimize campaigns, allocate budgets effectively, and truly gauge the ROI of their efforts.

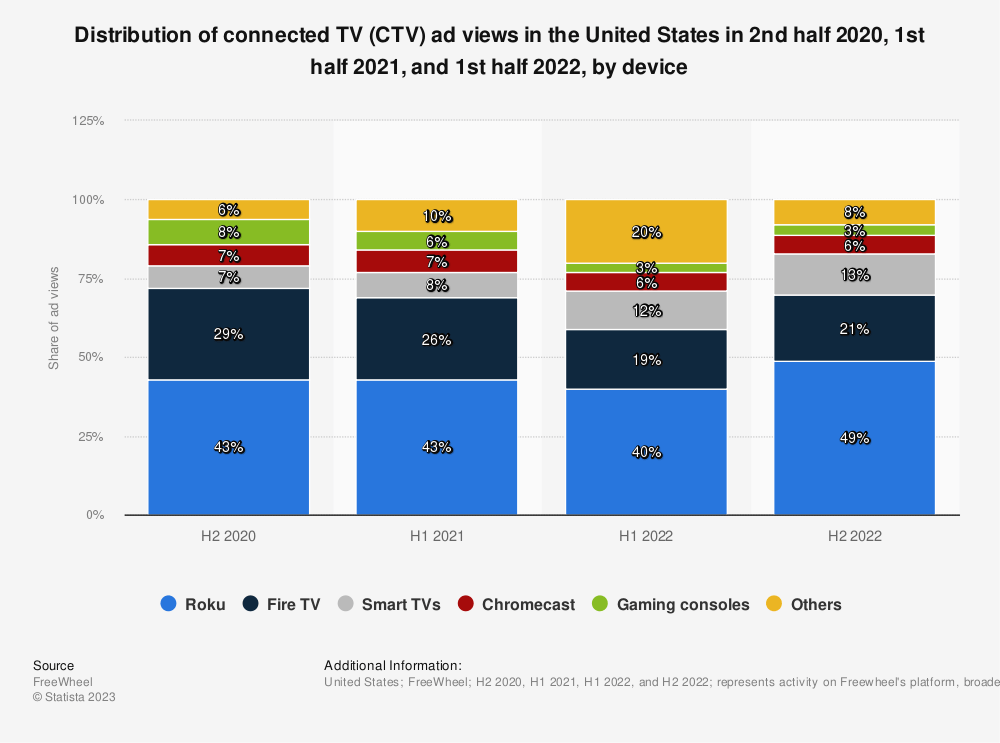

- In which devices users view CTV ads the most?

The data below shows that in the U.S. the Roku streaming devices, Fire TV and Smart TVs generate the most ad views.

Source: Statista

Final Words

Are you planning to optimize your CTV monetization strategy, or do you want to build an advanced understanding of delivering revenue uplift through a Connected TV experience?

Discovering the right tech stack goes hand in hand with identifying the right revenue optimization partner behind it. It would also be wise to embrace CTV monetization strategies to unlock the total value of content.

CTV monetization strategies will continue to change, evolve and improve. But Connected TV will always remain an essential part of publishers’ ad strategies because of its flexibility and revenue uplift.

FAQ

How does CTV advertising differ from traditional TV advertising?

CTV advertising is delivered through internet-connected devices like smart TVs and streaming sticks, allowing for targeted, personalized ads based on viewer behavior and preferences. Traditional TV advertising follows a scheduled broadcast, reaching a broader audience without the same level of personalization.

How can I measure the success of my CTV ad campaign?

Success in CTV ad campaigns can be measured using metrics like total impressions, ad completion rates, viewability, and cost per view. Additionally, tracking conversions, engagement rates, and audience reach can provide insights into campaign effectiveness.

What are the best practices to create engaging CTV ads?

For engaging CTV ads, focus on creating high-quality, relevant content tailored to your target audience. Ensure the ad’s length is appropriate for the platform, incorporate interactive elements like QR codes or clickable options, and maintain a clear and compelling call to action.

What steps can be taken to prevent ad fraud in CTV advertising?

To prevent ad fraud, work with trusted and verified partners, employ third-party fraud detection tools, monitor campaign metrics for anomalies, and stay updated on industry best practices and standards related to CTV ad fraud.

How can AI and machine learning improve CTV ad campaigns?

AI and machine learning can analyze vast amounts of data to optimize ad targeting, personalize content for individual viewers, predict viewer behavior, and automate real-time bidding processes, enhancing the efficiency and effectiveness of CTV ad campaigns.