Maximizing Ad Revenue with Floor Price Optimization

A price floor is a threshold CPM rate set by the publisher to prevent advertisers from buying impressions at low prices. It protects the ad inventory value, helps to maintain competitive bidding and prevents revenue losses during high-demand periods.

In this article we’ll delve deeper into floor prices, their types, and strategies for optimizing them!

Understanding Floor Price Optimization

Floor price optimization involves setting the right minimum price for ads to ensure they are sold at the best possible rate. This is crucial because it helps publishers maximize their revenue by preventing ads from being sold too cheaply.

What are Floor Prices?

Floor prices are the minimum CPM prices set by publishers for selling ad impressions in programmatic auctions. They act as a threshold, ensuring that ad space is not sold for less than the predetermined price.

Ad servers include the floor price in bid requests, informing buyers of the minimum acceptable bid. If bids don’t meet or exceed the floor price, those bids are filtered out and the impression isn’t sold.

You might wonder, how exactly they benefit publishers? It’s quite simple–price floors prevent undervaluation of ad inventory, protect revenue, and help to avoid low-quality ads that could negatively affect user experience.

Thus, price floors are very important for publishers because they set a minimum price for their ad space.

- For example, in private auctions, publishers know the prices and details of the deals. However, in open auctions, they don’t see the bid prices. Price floors make sure ads aren’t sold too cheaply in the auction, keeping the ad space valuable.

How Floor Prices Impact Ad Revenue?

Price floors filter out low bids, influencing auction dynamics by potentially increasing final bid amounts.

By setting a floor price, publishers ensure that their ad inventory is not sold below a certain value, which helps to maintain a baseline level of revenue per impression.

However, if floor prices are set too high, it can lead to reduced fill rates as fewer advertisers are willing to meet the high minimum price. This can negatively impact revenue as unsold inventory represents missed monetization opportunities.

Conversely, too low floor prices might increase fill rates but at the cost of undervaluing the inventory, resulting in lower overall revenue.

Optimizing floor prices involves a balance between setting a minimum price that protects revenue and ensuring competitive fill rates. Advanced strategies like dynamic floor pricing help to achieve this balance.

Types of Floor Prices: Static vs. Dynamic

Static floors

Static floor prices are fixed minimum prices set manually by publishers for their ad inventory. These prices remain constant until they are manually adjusted. Static floors are easier to implement and manage, as they do not require advanced algorithms or real-time data integration.

However, they lack the flexibility to adapt to market fluctuations, which can lead to missed revenue opportunities during periods of high demand or reduced fill rates during low demand.

- In short, static floors are fixed minimum prices set manually by publishers.

Dynamic floors

Dynamic floor prices automatically adjust based on real-time data and market conditions, using algorithms and real-time analytics. This allows a continuous optimization, ensuring that floor prices are always set at the optimal level to maximize revenue.

Dynamic floors are highly adaptable, responding swiftly to changes in advertiser demand and market trends, capturing higher bids during peak periods while maintaining competitive fill rates during low demand.

- In short, dynamic floors are prices that adjust automatically based on real-time data and market conditions.

The reason dynamic price floors are better than static price floors is that many factors influence the market. For example, prices on weekends might be different from prices on weekdays. Thus, an algorithm that adjusts price floors automatically can extract the maximum yield for the publisher.

Benefits of Optimized Floor Pricing

Here are the 4 main benefits of optimized price floors:

- Increased revenue

Optimized floor pricing ensures that the minimum price set for ad space is neither too low nor too high. By finding the optimal floor price, publishers can maximize their revenue by securing the highest possible bids for their inventory without leaving money on the table.

- Better fill rates

Setting the right floor price can lead to better fill rates, which means a higher percentage of the ad inventory is sold. If the floor price is too high, it might deter buyers, leading to unsold inventory. If it’s too low, the revenue potential is not fully realized. Optimized floor pricing strikes a balance that maximizes both revenue and fill rate.

- Enhanced advertiser trust

Advertisers are more likely to bid on inventory when they believe the pricing is fair and competitive. Optimized floor pricing builds trust with advertisers as it ensures that they are not overpaying for ad space.

- Improved user experience

When floor pricing is optimized, it can indirectly improve the user experience. Advertisers are willing to pay more for premium inventory, which often means higher-quality ads. This can result in fewer, more relevant ads for users, enhancing their overall experience on the platform.

Challenges in Floor Price Optimization

Balancing fill rate and CPM

One of the main challenges is finding the right balance between fill rate and CPM. A higher floor price can increase CPM but may reduce fill rates if advertisers are not willing to pay the higher price. Conversely, a lower floor price can increase fill rates but reduce CPM.

Adapting to market changes

The digital advertising market is dynamic, with demand and supply fluctuating frequently.

Floor prices that are optimal today might not be optimal tomorrow. Keeping up with these changes and adjusting floor prices accordingly is a continuous challenge. Thus, publishers need to be flexible and responsive to market trends and shifts in advertiser demand.

Technical implementation hurdles

Implementing optimized floor pricing can involve some technical challenges, such as:

- Integrating these tools with existing ad platforms;

- Ensuring real-time data processing;

- Maintaining system performance.

These technical complexities can be significant barriers, especially for smaller publishers with limited resources.

Prebid.js and Floor Prices

How Prebid.js Handles Floor Prices?

Prebid.js handles floor prices through Price Floors Module, which enables publishers to set and enforce minimum CPM prices for each auction. This module gives publishers the flexibility to define floor prices based on a variety of criteria.

Publishers can configure these floor prices on their own or work with a vendor who can provide optimized floors. The module supports multiple dimensions for setting these floors, including:

- AdUnit

- GPT Slot Name

- MediaType

- Ad Size

- Domain

- Custom dimensions (specific to Prebid.js.)

These rules are then read by bidder adapters and enforced on bid responses, ensuring that all bids meet or exceed the predefined floor price. This process can be carried out in any supported currency, allowing for global application.

Google Ad Manager (GAM) and Floor Prices

How GAM Manages Floor Prices?

GAM includes a floor price in bid requests that are sent to buyers, which is the minimum amount a bid must meet or exceed to be considered in the auction. This helps buyers understand the minimum acceptable bid for the inventory.

Note: In GAM, Unified Pricing Rules are responsible for enabling floor prices across different line item types to ensure consistent pricing in auctions.

Specific floor prices for individual items (such as particular advertisers, brands, or ad sizes) are not shared in these bid requests. This is because:

- GAM does not know the specific creative the buyer will use.

- It cannot guarantee that a specific item’s floor price will apply to the buyer’s creative.

For ad requests that allow multiple sizes, the lowest floor price among the eligible sizes is sent to the buyer. Even though specific floor prices for items are not shared in bid requests, these floor prices still apply in the auction if the buyer’s creative matches the targeted criteria.

Eligible line items: Price Priority, Network, and Bulk line items can participate in the auction. These line items must have a CPM that meets or exceeds the price set by unified pricing rules to be considered in the auction.

How to Set Up Price Floors in Google Ad Manager (GAM)?

Here are 5 steps that will help you to set up and optimize your floor prices in GAM:

- Begin by logging into your Google Ad Manager account.

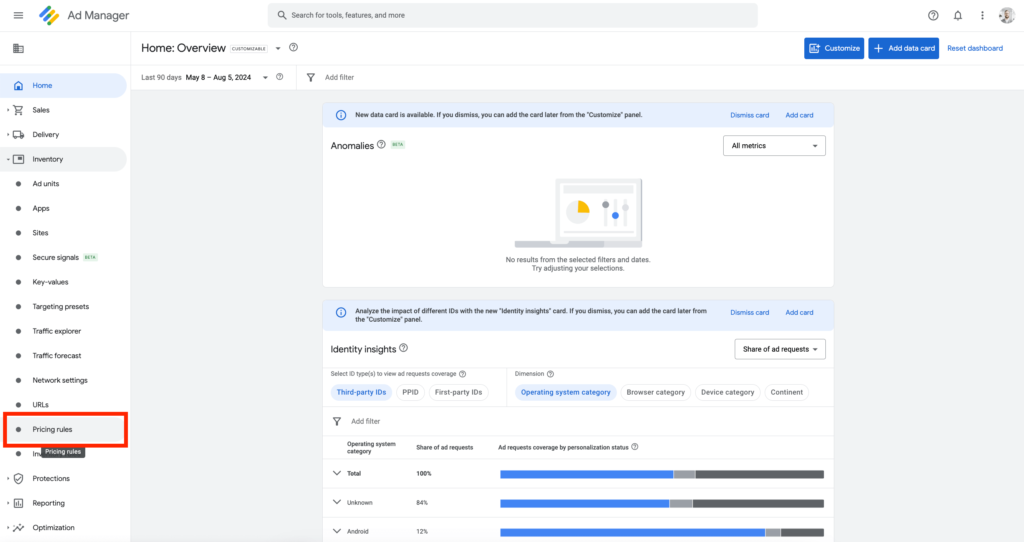

- Click on the Inventory tab, then select Pricing Rules to access the pricing rule settings.

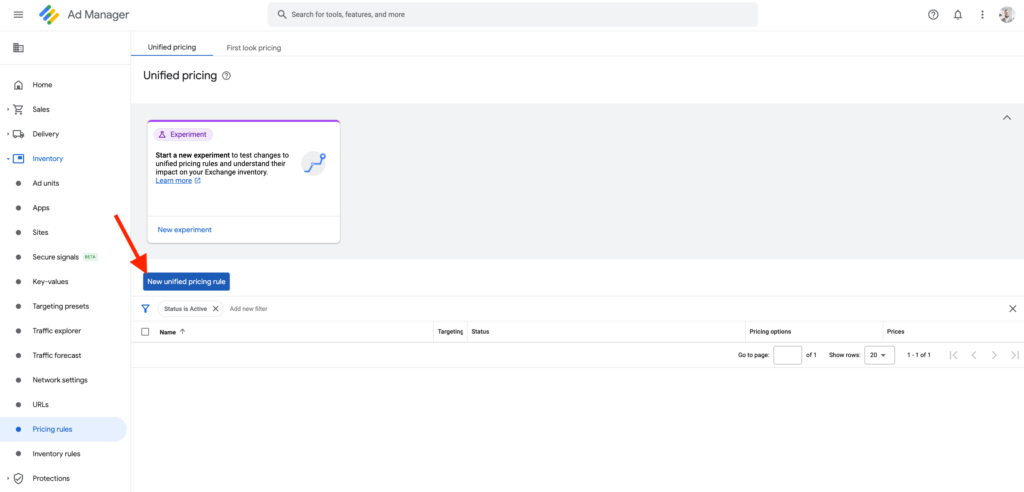

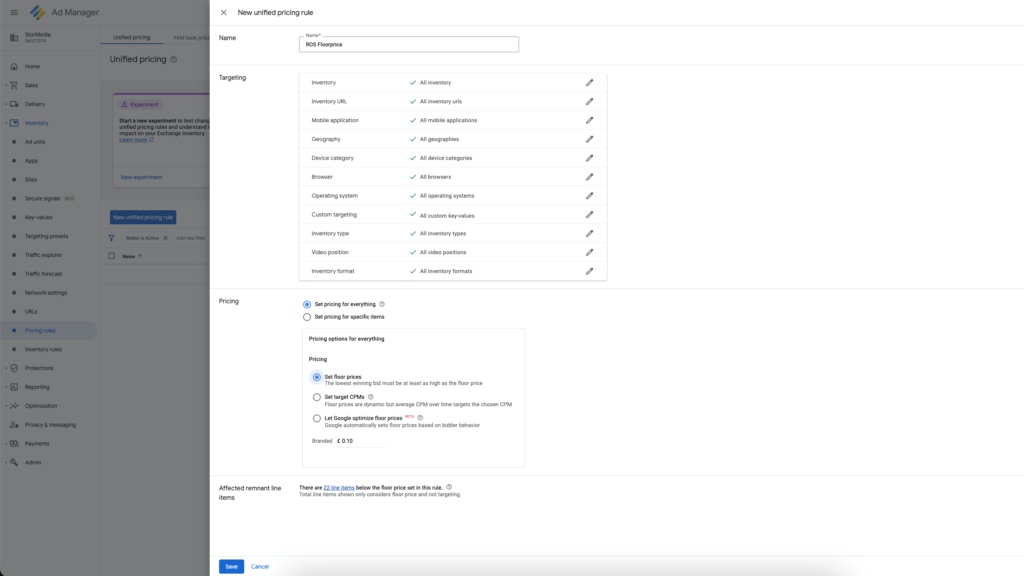

- Click New unified pricing rule to create a new rule, or choose an existing rule from the table to modify.

- Next to the Pricing section, make sure to select “Set pricing for everything”. Optimized floor prices are only supported under this option and not when pricing is set for specific items like advertisers, brands, sizes, or creative types.

Note: If you check the box for “Let Google optimize floor prices”, it will allow Google to automatically adjust the floor price to optimize your revenue.

- After configuring the necessary options, click Save to apply the changes. GAM will now automatically set and adjust the floor prices based on its optimization algorithms.

How Setupad Prebid Self-Serve Integrates with GAM for Floor Price Optimization?

With Setupad Prebid Self-Serve, publishers can maintain control over their floor prices in GAM by using Unified Pricing Rules. This allows publishers to manage their Prebid line items (those set up for header bidding) directly within GAM’s unified pricing structure.

To understand this better, let’s start with the basics.

Unified pricing rules in GAM are designed to create consistent pricing across various demand sources, including those from Prebid line items. This means that whether the bids come from header bidding, direct deals, or other sources, they all adhere to the same pricing rules you set in GAM.

With Setupad Prebid Self-Serve, publishers can define their floor prices within GAM’s interface.

You can create Unified Pricing Rules that apply to all or specific portions of your inventory. This setup gives publishers the flexibility to adjust floor prices dynamically across different segments or traffic sources while benefiting from Setupad’s advanced header bidding capabilities.

Additionally, Setupad’s partnerships with premium demand sources ensure that your inventory is exposed to high-quality bids, further enhancing revenue potential.

For publishers who prefer more hands-on support, Setupad also provides a fully managed service that includes personalized consultations, technical support, and ongoing optimizations. This allows publishers to focus on their core business while Setupad handles the complexities of floor price optimization and header bidding, ensuring the best possible outcomes.

Automation Strategies for Price Floors

Dynamic Floor Optimization

As already mentioned before, dynamic floor optimization uses algorithms and real-time data to continuously adjust floor prices. Thus, the minimum price for ad impressions adapts to current market conditions, maximizing revenue by responding to fluctuations in demand and supply.

Unlike static floors, which remain fixed, dynamic floors adjust automatically, ensuring that floor prices reflect real-time conditions. Publishers also spend less time manually updating prices, which results in a more efficient and responsive pricing strategy.

Implementing Dynamic Flooring in Prebid.js and GAM

- To integrate dynamic floor pricing in Prebid.js, publishers can use the price floors module, which allows for real-time adjustments based on factors like user behavior, geography, and device type.

- In GAM, publishers can set up unified pricing rules that dynamically adjust floor prices based on real-time bid data. This setup can be further enhanced with scripts or automation tools that fine-tune floor prices to maximize yield.

Manual vs. Automated Floor Price Management

Manual floor price management involves setting and adjusting floor prices by hand, giving publishers full control but requiring significant time and effort to keep prices optimized.

| Pros | Cons |

| Gives full control over floor prices, allowing for precise adjustments based on specific insights or strategies. | Requires significant time and effort to continuously monitor and adjust floor prices. |

| Allows for rapid response to immediate market changes or specific campaigns. | Prone to errors and inconsistencies due to manual data handling. |

| Enables highly customized strategies for different inventory segments. | Difficult to scale effectively, especially for large volumes of inventory. |

In contrast, automated floor price management uses algorithms and real-time data to automatically adjust floor prices, ensuring they are always optimized for current market conditions without the need for constant manual intervention.

While manual management offers more customization, automation is more efficient and can help maximize revenue with less effort.

Choosing the Right Approach for Your Needs

- Manual management–best suited for smaller publishers or those with highly specific pricing strategies that require granular control.

- Automation–ideal for larger publishers or those looking to leverage data-driven insights to optimize floor pricing efficiently and consistently.

- Hybrid approach–combining both methods can offer a balanced solution, using automation for baseline adjustments and manual intervention for specific strategic decisions. However, it is crucial to avoid overlapping these two methods. When Google-optimized price rules overlap with manual rules, the optimized rules will override the manual ones. This override can lead to unintended pricing behaviors, such as treating a minimum CPM as a target CPM, which may not align with your intended pricing strategy. Ensure that each pricing rule is distinct to maintain control over your ad inventory pricing.

If you’re unsure whether to choose a fully managed solution or try a more hands-on manual approach, you can consult a trusted partner like Setupad to determine the best fit for your needs.

Strategies for Effective Price Floor Management

Here’s a small recap of 5 strategies you should take into consideration for a more effective price floor management:

- Dynamic floor optimization. Use algorithms to adjust floor prices in real-time based on market conditions, demand, and performance metrics.

- Granular controls. Set different floor prices based on criteria like geography, device type, or specific web pages to better match inventory value with market demand.

- Historical data analysis. Analyze past transaction data to identify trends and set accurate price floors that reflect historical value.

- Competitive analysis. Monitor and adjust floor prices based on competitor pricing to remain competitive in the market.

- Technological tool. Implement advanced ad server capabilities to automate and fine-tune floor price adjustments continuously.

Advanced Techniques in Floor Price Optimization

Real-Time Bidding Adjustments

Real-time bidding (RTB) adjustments involve changing floor prices based on real-time data. This technique leverages real-time analytics to adjust floor prices, responding to current demand and supply conditions.

- For example, if there’s a surge in bid activity for a particular ad space, the floor price can be automatically increased to maximize revenue. Conversely, if bids are low, the floor price can be lowered to improve fill rates. This approach ensures that floor prices are always optimized based on the latest market conditions.

Geo-Specific Floors

Geo-specific floor pricing involves setting different floor prices for ad inventory based on the geographic location of the user. Advertisers often value users from different regions differently based on purchasing power, market demand, and campaign goals.

- For example, users in high-value markets like the USA may command higher floor prices compared to users in regions with lower ad spending. By customizing floor prices based on geographic data, publishers better match the value of their inventory to advertiser demand.

Device-Specific Floors

Device-specific floor pricing sets different minimum prices for ad inventory based on the type of device the user is using (e.g., desktop, mobile, tablet). Advertisers might value impressions differently depending on the device due to factors like screen size, user engagement, and conversion rates.

- For example, mobile users might be more valuable for certain types of campaigns, leading to higher floor prices for mobile inventory. By differentiating floor prices based on device type, publishers can better align their pricing strategies with advertiser preferences and behaviors.

Common Mistakes to Avoid

Over-Reliance on Static Floors

Static floor pricing refers to setting a fixed minimum price for ad inventory and not adjusting it based on changing market conditions. This can lead to suboptimal revenue outcomes.

- For example, during high-demand periods, a static floor price may be too low, causing lost revenue opportunities. On the other hand, in low-demand periods, it may be too high, resulting in unsold inventory.

Successful optimization requires dynamic floor pricing that adjusts in real-time based on market conditions, demand, and performance data.

Ignoring Market Signals

Market signals include data and trends that indicate changes in advertiser demand, bid amounts, and competitive landscape. Ignoring these signals can lead to mispriced ad inventory.

- For example, if there’s a surge in demand for certain ad spaces or formats, ignoring these signals means missing out on the opportunity to adjust floor prices upwards to capture higher revenues.

Publishers must continuously monitor and analyze market signals to make informed adjustments to floor prices, ensuring they align with current market conditions and advertiser behavior.

Not Regularly Updating Floors

The digital advertising market is highly dynamic, with rapid changes in advertiser budgets, campaign goals, and market trends. Failing to regularly update floor prices can result in pricing that is out of sync with the market.

Regular updates ensure that floor prices reflect the most recent data and trends, maximizing fill rates and CPM. This involves using automated tools and algorithms that can adjust floor prices in real-time, as well as periodic manual reviews to ensure the pricing strategy remains effective.

Conclusion

Price floor optimization is crucial for maximizing ad revenue, but it requires ongoing monitoring and careful analysis of demand channels. There is no one-size-fits-all solution. Each publisher must tailor their approach to the specific dynamics of their inventory and market.

To achieve the best results, it’s essential to avoid drastic changes to floor prices. Instead, make incremental adjustments, such as changing the floor price by small amounts, based on a thorough analysis of the average CPM from demand partners. This method ensures that floor prices remain competitive and effective, helping to optimize revenue without disrupting fill rates.

However, remember that A/B testing is more challenging in first-price auctions, and optimizing price floors demands significant time and attention. Thus, you can optimize price floors yourself or join Setupad and let us handle it for you!

FAQs

What is a floor price in digital advertising?

A floor price is the minimum bid a publisher sets for selling an ad impression, ensuring that ad space isn’t sold below a predetermined value.

How do I set a floor price in Prebid.js?

In Prebid.js, you can set a floor price using the Price Floors Module, which allows you to define floors based on various criteria like ad unit, size, and media type.

What are the benefits of dynamic floor pricing?

Dynamic floor pricing automatically adjusts based on real-time market data, helping to maximize revenue by ensuring floor prices are always optimized for current demand.

How often should floor prices be adjusted?

Floor prices should be adjusted regularly or in response to significant changes in market conditions to ensure they remain competitive and effective.

What tools can help with floor price automation?

Tools like Google Ad Manager, Prebid.js with the Price Floors Module can automate and optimize floor price management.