Inside DMEXCO 2024: Key Trends Shaping Digital Advertising

DMEXCO, Europe’s premier digital marketing and tech held annually in Cologne, brings together leaders from across the advertising ecosystem to explore the latest innovations shaping the future of advertising and marketing.

This year, the Setupad team attended the event and dived deep into discussions around a post-cookie world, AI-driven strategies, the state of Europe’s digital advertising market, and evolving privacy regulations. In this recap, we’ll unpack the major takeaways from the event and highlight how advertisers, publishers, and tech platforms are preparing for the future of programmatic advertising.

Strategies for a post-cookie advertising world

As cookies lose their effectiveness, a staggering 70% of online audiences remain unaddressable, posing significant hurdles for both advertisers and publishers. Advertisers are grappling with a loss of scale, while publishers are facing a direct hit on their revenue streams.

To bridge the gap, brands need to adopt a multi-faceted approach. First-party data remains valuable but lacks scale. Contextual data, which is privacy-friendly, is not precise enough to provide the necessary targeting. Additionally, probabilistic approaches, such as household-based cohorts, offer a new avenue for marketers to reach potential audiences effectively without relying on cookies.

However, it’s clear that to navigate the post-cookie world, a unified data strategy combining probabilistic and deterministic methods, enhanced by AI and machine learning, is going to be a secret formula for success. Brands and agencies must also ramp up their analytics capabilities to understand audience behavior more deeply, either by building in-house expertise or partnering externally.

The ongoing measurement challenge

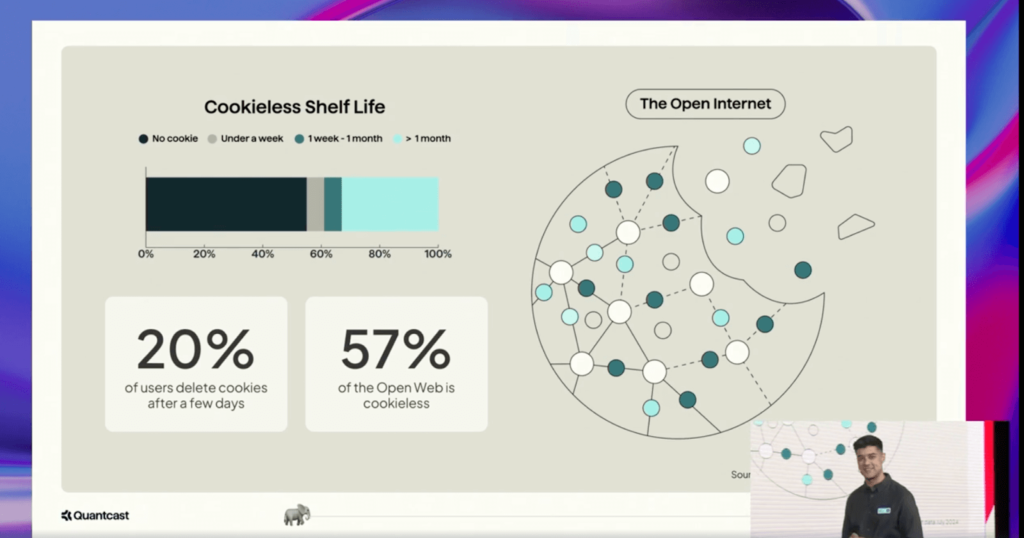

The loss of cookies is fundamentally disrupting addressability in digital advertising, as cookies have been the backbone of the ad tech industry for years.

As Amit Kotecha, CMO at Quantcast, bluntly put it: “No matter what anyone in this conference tells you, cookies have gone. We have been preparing for the last four years for a world without cookies.”

This shift is impacting advertisers’ performance, leading to diminished returns compared to 5-10 years ago. As a result, there’s less funding for original content and free services, which many people have enjoyed without the need for subscriptions.

While much of the focus has been on finding alternative targeting solutions in a cookieless world, the real hurdle is still in measurement. Many targeting tools exist and work efficiently, but what truly drives the effectiveness of digital campaigns across search, social, and programamtic is the ability to measure and optimize.

With the shift towards a cookieless world, digital advertising strategies must evolve. New methodologies and tools—like conversion modeling and AI-driven measurement—are becoming essential. Instead of using fragmented data for each channel, there’s a growing belief that marketers should streamline audience targeting across all digital platforms.

Latest developments in Privacy Sandbox

The Privacy Sandbox team gave an in-depth presentation on their ongoing work with SSPs, DSPs, and publishers, emphasizing collaborative efforts to shape the post-cookie landscape. Here are the key takeaways:

- Viability: Ad tech companies have proven that it’s possible to serve and measure ads using privacy-preserving technologies.

- Participation: Broad participation across the ecosystem is crucial. Many companies have begun testing the APIs, though adoption has been slower than expected, largely due to the wait for a more concrete timeline on full cookie deprecation.

- Feedback: Ongoing feedback from the industry is shaping key enhancements in Privacy Sandbox, demonstrating that collaboration is a driving force behind its evolution.

For context, the Privacy Sandbox right now consists of two main parts: reducing cross-site tracking and offering APIs (such as Protected Audiences and Topics) to serve as alternatives to third-party cookies. These APIs are currently available for testing, but the official deprecation of third-party cookies in Chrome is targeted for early 2025, leaving many ad tech players cautious about fully committing to the new infrastructure until a clearer timeline is confirmed.

Some of the most recent innovations, as outlined in Google’s latest blog post, include supporting more detailed deal information in the Protected Audience API, introducing “clickiness” signals to enhance ad bidding accuracy, and extending the lifespan of interest groups from 30 to 90 days (particularly beneficial for industries like travel and automotive, which have longer sales cycles). According to Google, these changes are aimed at balancing ad performance with user privacy, encouraging continued collaboration across the ad tech ecosystem.

Richard Mooney, Chief Data & Technology Officer at GroupM, highlighted the importance of industry-wide collaboration in testing Privacy Sandbox features. While initial functional tests have proven the utility of these new tools, he pointed out that investment levels remain low, and adoption is sluggish.

Mooney urged the buy side to begin building features that take advantage of these signals and to ramp up test budgets in preparation for the full transition. He also noted that as Google’s user choice mechanism is gradually rolled out, the majority of users are likely to disable third-party cookies anyway, further driving the need for these alternative solutions.

Identity resolution: trends and predictions

The importance of omnichannel marketing lies in creating unified customer journeys across multiple identifiers and platforms, with identity resolution playing a key role in seamless cross-channel targeting. To succeed, companies need to implement strong privacy measures and ensure transparent data use policies, fostering customer trust from initial consent to more advanced personalized experiences.

Many companies fall short in tech management and integration, leading to fragmented data. However, Dr. Dirk Rohweder, COO and Co-founder of Teavaro, suggests that a well-developed identity graph (linking customer data across devices) can enhance targeting accuracy and overall marketing outcomes.

Leveraging identifiers such as email addresses and device IDs significantly boosts customer identification rates, potentially allowing companies to track up to 60-70% of their users, compared to the 30-40% achieved through cookie-based methods.

This, in turn, improves personalization and retargeting, leading to better engagement and higher conversion rates. While building an identity-driven marketing strategy may seem daunting, it can be done incrementally. Marketers can begin with small-scale tests, progressively integrating more channels while ensuring legal compliance and proper privacy practices.

Earning customer trust is also fundamental in gathering the data needed for personalized marketing. Consumers are more likely to share their data when they perceive clear value in exchange, making transparency and communication key to any successful strategy.

New opportunities, such as IP-based targeting by telecom providers, are emerging as precise alternatives, enabling more accurate audience segmentation, improving frequency capping, and boosting marketing efficiency across various publishers.

The AI frontier

AI remains a hot topic and its impact on content creation was a central discussion point at DMEXCO. The industry leaders called for increased publisher attention to AI-generated content to ensure it’s trustworthy and reliable.

AI has also proven highly effective in improving media efficiency, especially in areas like planning and measurement. It can optimize complex tasks, ensuring that media strategies are executed with higher precision and lower resource use.

According to Robert Jozic, Managing Director at Schwarz Media, “Everything that can be automated, can be optimized with AI.”

This echoes what Google is doing by bringing its AI advancements into its ad infrastructure. A combination of Predictive AI (which powers bidding and audience targeting) and Generative AI (which creates assets like visuals and copy), these technologies offer better ROI by improving both targeting and creative development, particularly in areas like language generation and asset creation.

AI is also increasingly being applied to retail media, allowing for better measurement of effectiveness and incrementality in campaigns. Organizations like IAB Europe and MRC are working on standardizing AI-driven measurement systems, aiming to improve how retail media performance is tracked and optimized.

First-party data is also the most valuable asset in AI-driven campaigns. The quality of AI’s performance, especially in personalized content and targeting, depends heavily on having access to accurate and robust first-party data.

There are also growing concerns around regulation and anti-competitive practices with AI. Laws like the DMA (Digital Markets Act) and DSA (Digital Services Act) are reshaping the media ecosystem, promoting collaboration between multiple players rather than reliance on a single partner. Companies will need to adopt a “best of breed” approach, leveraging AI tools from different providers to stay competitive and compliant.

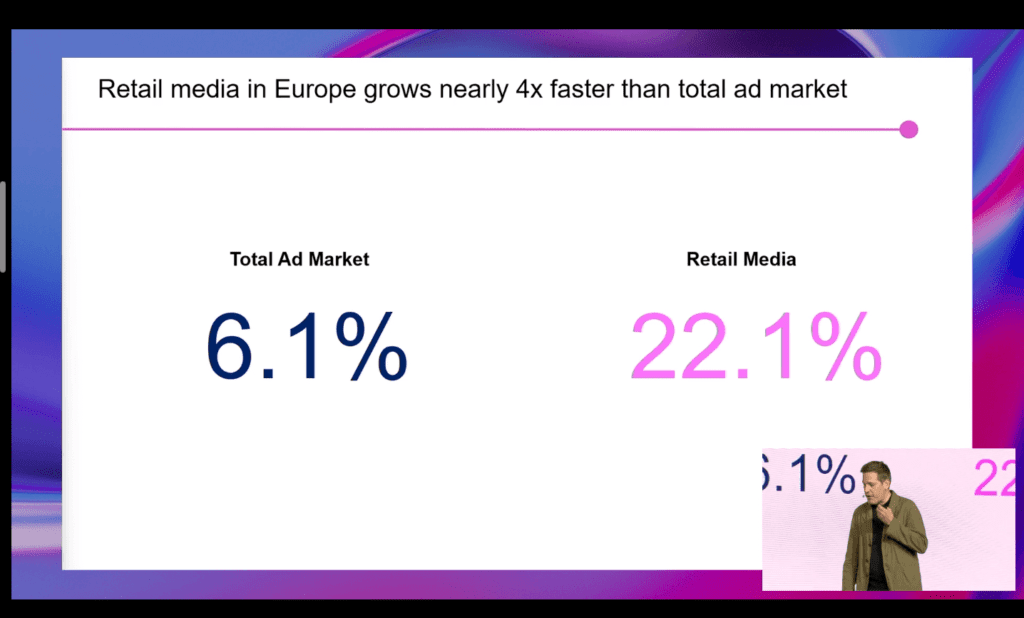

Retail media is still booming

Retail media, a market that’s been steadily growing faster than almost any other form of ad spend in the last few years, is expanding rapidly across Europe, driven by increasing adoption among retailers and advancements in technology. This trend is set to accelerate further, as second-mover markets are expected to join in and fuel further growth over the next 4-5 years.

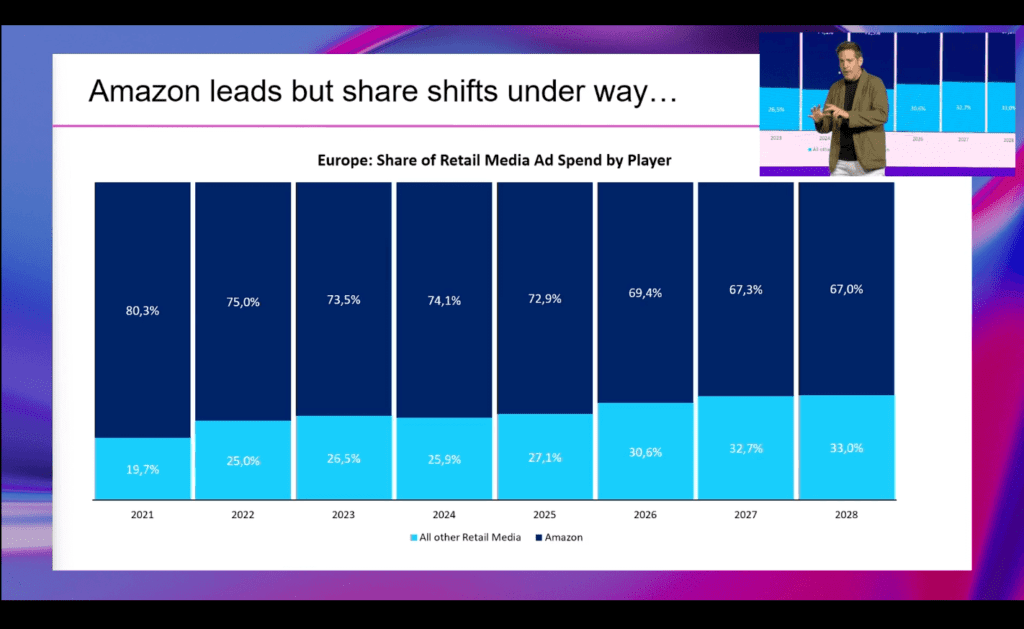

While Amazon continues to lead the retail media landscape, significant market share shifts are underway. Other retail media networks (RMNs) are gaining ground, currently accounting for anywhere between 25% to 33% of the market.

Search advertising is currently the dominant format within retail media. It’s often the first format retailers adopt due to its ease of implementation and scalability. Retail media search already represents nearly 20% of total search revenues in Europe.

However, display and service-based formats are starting to gain momentum, offering more diverse options for retailers to engage customers. AI technologies, yet again, are likely contributors to this shift.

As AI-powered platforms become more prevalent, retailers can predict consumer behavior more accurately and optimize ad placements in real-time, which enhances overall campaign performance. Retailers are increasingly leveraging AI to generate valuable insights from their first-party data, which can be monetized by offering advertisers more detailed customer segmentation and performance reporting. This development presents a promising revenue stream for retailers, outside traditional media placements.

Moving forward, AI will likely play a central role in the expansion of retail media formats, particularly in integrating search, display, and service ads into a seamless customer journey. With advances in AI, retailers will be able to automate and optimize ad delivery more efficiently, offering hyper-personalized experiences and better ROI for advertisers.

As mentioned before, with AI becoming more integral to retail media, there will be a growing focus on first-party data to drive more effective targeting. However, this also increases the need for strict data privacy regulations and consumer consent mechanisms, especially as the EU continues to lead the way in privacy protections under the GDPR.

AI and brand safety: the double-edged sword

Despite some improvements in combating ad fraud and protecting brand safety, challenges such as brand safety risks, particularly around major events and MFA (made for advertising) sites, still persist.

Misinformation is a global challenge, affecting multiple sectors, including the advertising industry. According to the World Economic Forum, misinformation is ranked as the number one issue facing society today. In 2024, over 60 countries will hold elections, amplifying concerns about the spread of false information. As such, advertisers face growing pressure to ensure their campaigns do not inadvertently support or promote misinformation.

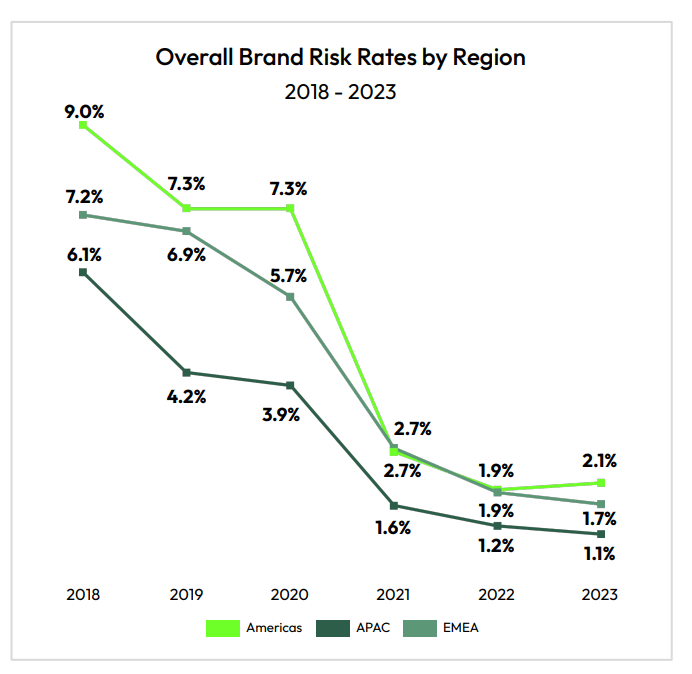

While global brand risk (exposure to harmful content) remained relatively stable across regions at 1.7% in 2023, the Americas saw an increase to 2.1%, likely driven by political events. Emerging threats like AI-generated deep fakes are expected to challenge brand safety further in the future.

Source: IAS

For instance, 82% of B2C marketing executives in the US have expressed worry about investing in advertising during the election cycle due to the potential association with misinformation. This concern translates to European markets as well, where elections will present similar challenges.

Advertisers are becoming increasingly concerned, and rightly so. Research shows that 25% of consumers hold brands and advertisers accountable for misinformation.

So, how does AI come into play? According to Khurrum Malik, CMO at Integral Ad Science (IAS), AI is seen as both a cause of and a solution to the misinformation problem. As AI-generated content becomes more prevalent, the risk of misinformation increases. AI can also be a powerful tool to combat misinformation by analyzing content at the frame, text, and audio levels to detect false information in real-time, helping advertisers avoid brand risk.

Adtech platforms are developing and using AI tools to help advertisers measure the effectiveness of their ads and detect misinformation across various channels, including social media, open web, and audio, and allow brands to understand where their ads are running and whether they are being placed next to false or harmful content. However, these tools still lack mainstream adoption because of the current costs and operational challenges and as a result, their effectiveness is still widely questioned.

European digital ad market defies economic uncertainty and continues to grow

Despite the headwinds caused by inflation and economic uncertainty, Europe’s digital ad market continues to grow, with €96.9bn in digital ad spend in 2023, representing a 11.1% year-over-year growth. Adjusted for inflation, Europe’s market is growing faster than the U.S.

This year also marks Europe’s second-highest year of net additions. Digital advertising now accounts for 63% of total media ad spend, with display, search, and social formats driving much of the growth. However, regulatory hurdles, particularly around third-party cookie deprecation, could slow growth in certain sectors, such as display.

Digital advertising dominates 63% of all media ad spend. Display, search (driven by retail media), and social formats continue to grow, with CTV and podcast advertising showing exponential increases.

Looking ahead to 2024, the European market is expected to grow by another 8.1%, buoyed by improved advertiser strategies and an expanding focus on first-party data and privacy-enhancing technologies.

IAB Europe team has presented it’s annual “Programmatic Advertising in Europe: 10 Years of Trends, Attitudes and Growth Drivers” report, highlighting that the quality of media, namely, ad fraud, brand safety, viewability, and transparency, is the largest concern for future investments across agencies, advertisers, and publishers.

The report also uncovered that the programmatic continues to mature, with audience discovery (38%) and control/transparency (25%) being top drivers for advertisers.

Publishers focus on first-party data, while advertisers and agencies explore broader data strategies and prepare for the post-cookie era, with many turning to contextual data and identity solutions.

To nobody’s surprise, the main challenges are associated with the cookie-less preparedness across all parties, with less than 1 in 2 advertisers feeling ready for the shift beyond third-party cookies.

Final words

A key theme in digital advertising for the past 4 years is the loss of signal. While it’s still debatable whether the future of digital advertising will be entirely cookie-free, what is really clear now is that access to cookie data will be limited. Publishers will need to combine first-party and third-party data, relying more on probabilistic modeling rather than deterministic user-level data. This creates challenges for publishers, who may struggle to prove the reach and effectiveness of their ads without precise, certifiable data.

Measurement is evolving, and publishers must demonstrate delivery accuracy while advertisers adapt to new standards for evaluating campaign performance. The event highlighted the need for collaboration between SSPs, DSPs, and publishers and growing AI’s role in shaping future omnichannel strategies.