GAM Floor Prices vs. Prebid Floor Prices: Understanding the Difference

Google Ad Manager and Prebid floor prices offer distinct approaches to managing minimum bid thresholds. GAM focuses on consistency across demand sources, while Prebid allows for granular, real-time adjustments–but why is it important to understand these differences?

The answer lies in the impact on a publisher’s revenue and the effectiveness of their inventory monetization strategy. Setting the right floor price ensures publishers aren’t underselling their ad space while encouraging maximum buyer competition.

Interested to learn more?

In this article, we’ll explore the differences between GAM and Prebid floor prices, highlighting their unique functionalities, implementation methods, and best-to-use scenarios to help publishers make decisions that maximize ad yield.

What Are Floor Prices in Programmatic Advertising?

A price floor, also called a floor price, is the minimum price an ad can be sold for on a platform, ensuring that advertisers can’t buy below this amount. This guarantees a certain level of revenue per ad for the publisher.

Optimized price floors can lead to higher-quality ads since cheaper, lower-quality ads may not meet the floor.

However, setting the price too high can lead to fewer sales and more unsold ad spots, which could reduce overall revenue. So, finding the right balance is essential for publishers to maximize their earnings.

Overview of GAM Floor Prices

Google Ad Manager (GAM) helps publishers to manage, deliver, and optimize ads across various digital channels, including web, mobile apps, and video. One of GAM’s key features is its floor pricing mechanism, which ensures that ad inventory is not sold below a certain value.

Unified Pricing Rules (UPR)

The unified pricing rule framework in GAM standardizes how floor prices are applied across multiple demand sources, including Google Ad Exchange, header bidding partners, and other third-party exchanges.

In short, UPR serves as a centralized mechanism for implementing consistent and strategic pricing rules across publisher’s ad inventory.

Before UPR, publishers had to set separate pricing rules for each demand source, which could cause inconsistencies. UPR simplifies this process by offering a unified set of rules for all indirect demand sources. This ensures a more predictable and transparent auction outcomes.

Here are the 3 key features of UPR:

- Global floor prices. Publishers can define a minimum acceptable CPM for their inventory, ensuring consistent floor prices across all eligible demand sources.

- Custom rules. Publishers can create custom pricing rules based on specific criteria such as ad unit, device type, geographic location, and format.

- Auction uniformity. UPR enforces the same pricing rules across all participating demand sources, including Google’s own platforms, reducing the risk of preferential treatment or “soft floors” for specific buyers.

Explanation of GAM floor price mechanics

GAM floor prices operate within the context of programmatic ad auctions.

When a bid request is generated, it is subjected to the applicable UPR rules that define a minimum acceptable CPM. If a bid fails to meet this minimum threshold, it is disqualified from the auction. This ensures that inventory is not undersold.

Static vs. dynamic floor prices in GAM

Here are 2 bid types in GAM:

- Static floors. These are fixed floor prices set by the publisher. Every bid that fails to meet the static floor is automatically rejected, ensuring a predictable minimum value for impressions.

Publishers manually define static floors, which remain constant unless adjusted. This provides predictability and stability but may miss opportunities for revenue maximization during periods of high demand. Static floors are typically used for baseline protection, ensuring that inventory is never sold below a certain value.

- Dynamic floors. Dynamic floors adjust automatically based on market conditions and demand signals. For example, a dynamic floor may increase when demand for certain inventory types spikes, allowing publishers to capitalize on increased buyer competition.

Dynamic floors allow for greater revenue maximization in competitive environments. Adjustments can be influenced by factors such as historical bid data, seasonal trends, and buyer behavior. The primary advantage of dynamic floors is their responsiveness to market changes, which can result in higher CPMs during periods of increased competition.

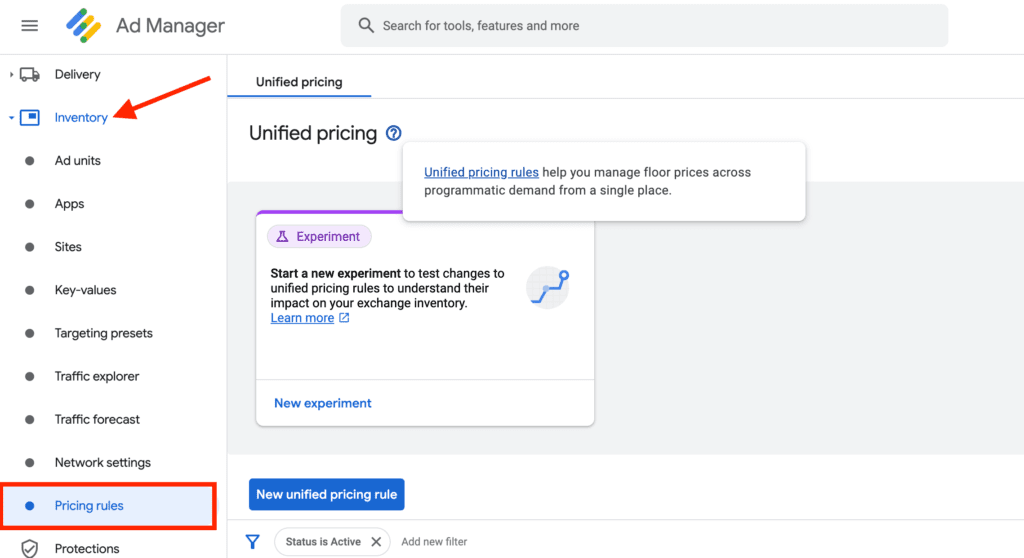

How are floor prices configured in GAM’s interface?

Configuring floor prices in GAM is accomplished through a straightforward interface that enables publishers to set and customize their floor pricing rules.

Here are 5 steps that show how it typically works:

- Accessing UPR. Navigate to the

Pricing Rulessection within the GAM interface. SelectUnified Pricing Rulesto create or modify existing rules.

- Setting the floor price. Publishers can define a minimum CPM value that will serve as the floor for eligible inventory. Custom criteria, such as ad units, geography, device types, and even specific buyers, can be applied.

- Applying and managing rules. Rules can be activated, deactivated, or modified at any time. Publishers can create multiple rules to cover different inventory segments or use cases. The interface provides detailed reporting and analytics on these rules’ performance, enabling data-driven optimizations.

- Monitoring and reporting. GAM’s reporting tools allow publishers to monitor the impact of floor prices on revenue and demand behavior.

Overview of Prebid Floor Prices

Prebid is a widely used open-source header bidding solution that empowers publishers to maximize ad revenue by creating competition among multiple demand sources for each ad impression.

Prebid offers a range of modules designed to optimize ad monetization for publishers. Among these modules is the price floors module, which allows publishers to set minimum acceptable bid prices for their ad inventory.

Explanation of Prebid’s floor price functionality

Prebid enables publishers to set minimum bids that buyers must meet or exceed to win an ad impression. By doing this, publishers can protect the value of their inventory, avoid underselling, and create competition that drives up CPM.

Prebid’s price floors module helps publishers set minimum prices for their ad inventory to ensure ads are sold at or above a certain value.

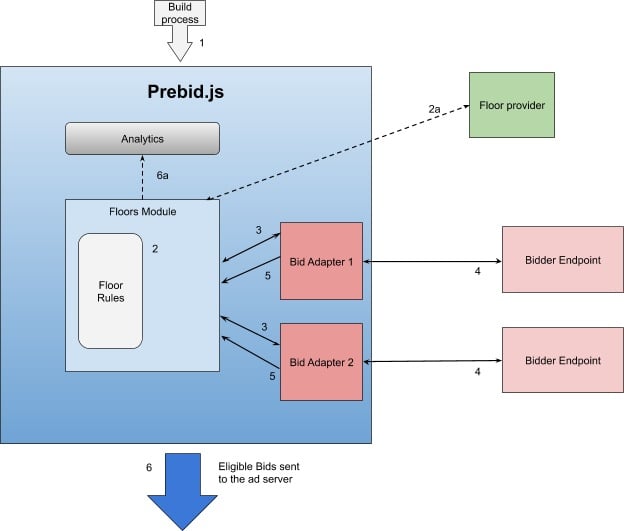

Here’s a 7 step breakdown of how Prebid’s price floors module works:

- When creating a Prebid.js package, you need to include the Price Floors Module by using a specific command (

gulp build --modules=priceFloors). Once activated, the module prepares floor rules for every ad auction.

- The price floors module starts working as soon as you use

setConfig({floors}). This configuration helps create internal rules (organized in a table) for each auction. These rules can come from different places, such as a dynamic source, predefined settings, or specific ad units.

- If you have defined an endpoint URL for dynamic floor data, the module tries to fetch updated floor prices from there. When you call

requestBids(asking for bids from advertisers), the module may pause the auction briefly to wait for updated floor prices, but only for a specified amount of time.

- If you want to test whether having a floor price impacts revenue, you can use a

“skip rate”option. This lets the module decide whether to enforce the floor price or skip it for certain bids during testing.

- When advertisers place bids, the bid adapters (systems that connect buyers and sellers) use the

getFloor()method to determine the appropriate floor price for each ad slot, considering factors like media type and ad size. If needed, the module converts the currency for floors to match the bid’s currency.

- The bid adapters then send these bids (which must meet or exceed the defined floor prices) to their respective bidding endpoints. Once bids are received, the module checks each one to make sure it meets the minimum floor price. If it doesn’t, the bid is rejected.

- Any bid that meets the floor requirements is passed on to the Prebid core system and sent to the publisher’s ad server for final consideration. The module also sends data about floor performance to analytics tools, helping publishers optimize their floor strategies over time.

Source: Prebid

Dynamic Floor Module in Prebid.js

The dynamic floor module in Prebid.js offers even more sophisticated floor price capabilities. Unlike static floor settings, this module allows publishers to set dynamic floor prices that can be adjusted in real-time based on data and market conditions.

Key features of the dynamic floor module include:

- Real-time adaptation. Floor prices can change dynamically based on user characteristics, contextual data, and other real-time factors.

- Enhanced control. Publishers can fine-tune floor prices to reflect changes in demand, seasonality, and other external influences, maximizing revenue potential.

- Flexibility with configuration. Dynamic floors can be configured directly within Prebid.js or sourced from an external data service to ensure floors are optimized for current market conditions.

Floor settings based on criteria like device, geo, and ad size

Prebid’s floor price functionality allows publishers to set floors based on a wide range of criteria. Thus, publishers can create granular floor pricing strategies that optimize revenue for individual inventory segments.

Now, let’s look at the 3 most common criterias used.

First, device type criteria–allows setting different floor prices based on the type of device accessing the content. For example, setting higher floors for mobile traffic, where demand is strong, and lower floors for desktop if performance justifies it.

Second, geographic location–adjusts floor prices based on the geographic region of the user. For example, higher floors for high-demand regions such as the US, and lower floors for regions with lower demand or CPMs.

Third, ad size criteria–enables floor pricing tailored to specific ad dimensions/formats. For example, larger floor prices for high-impact formats like 300×600 (large rectangles) or video units, while setting lower floors for smaller banner ads like 300×250.

Key Differences Between GAM and Prebid Floor Prices

When choosing the right floor strategy, publishers may benefit from a hybrid approach, using GAM for baseline control and consistency while leveraging Prebid’s dynamic floors for more granular, responsive auction strategies.

Below are the key differences between GAM and Prebid floor prices regarding implementation, scope, granularity, and impact on header bidding.

| Aspect | GAM | Prebid |

| Implementation | Easy, centralized configuration through GAM interface, typically static floors. | It requires technical expertise and is highly customizable through Prebid.js or dynamic floor module. |

| Scope | Applies to all demand sources connected to GAM, including Google’s exchange. | Primarily focused on header bidding demand partners; greater flexibility within auctions. |

| Granularity | Moderate, UPR allows for broad rule application but is less detailed than Prebid. | High floors can be set for specific bidders, devices, regions, etc., with real-time changes. |

| Impact on header bidding | Ensures consistent floor pricing across GAM auctions; less dynamic for rapid changes. | Optimized for header bidding, with granular control and dynamic adjustments for auctions. |

Implementation

Google Ad Manager

Unified Pricing Rules (UPR) are implemented through a centralized interface within GAM. Setting up floor prices in GAM involves configuring UPR rules that apply uniformly across all demand sources.

Implementation is relatively straightforward and accessible to publishers without deep technical expertise. Publishers can create and modify rules through the GAM dashboard with customization options for specific ad units, buyer categories, and more.

GAM’s floors are often static, meaning changes require manual intervention unless otherwise adjusted periodically or through additional automation tools available in GAM’s ecosystem.

Prebid

Prebid’s floor prices are implemented within the Prebid.js configuration or through a Dynamic Floor Module that can be customized in real-time based on various conditions. The setup process involves defining floors for specific ad units, bidders, device types, or even dynamically based on market conditions.

Implementation in Prebid can be more complex and often requires technical expertise, as it involves setting up Prebid.js scripts or using external data services for real-time dynamic adjustments.

Prebid floors can be dynamic, meaning they can change automatically based on market trends, user data, or other real-time signals, maximizing potential revenue with minimal manual input.

Scope

Google Ad Manager

The scope of GAM’s floor pricing extends to all demand sources integrated through the GAM platform. Unified Pricing Rules ensure that floors are applied consistently across Google demand (e.g., AdX) and other third-party exchanges and networks.

It offers a broader application across all demand sources connected to the ad server, maintaining consistency in pricing. This level of uniformity can benefit publishers who prioritize transparency and consistency.

Prebid

Prebid floors primarily focus on header bidding demand, providing greater granularity and flexibility within open web auctions where multiple demand partners compete for impressions. Prebid does not extend to Google’s exchange demand outside the header bidding context (except when integrated through Google Ad Manager).

The scope is more limited to specific partners and bidders in the header bidding environment, but it allows for more granular control over which bidders or auction rules are applied.

Granularity

Google Ad Manager

GAM’s UPR offers a reasonable level of customization through rules that can be set based on ad unit type, geographic location, device type, and other parameters. However, customization is less granular than the dynamic flexibility offered by Prebid.

While it is possible to create multiple pricing rules within GAM, adjustments are often applied at the broader demand source level, and more specific, nuanced adjustments (e.g., per bidder) may not be feasible without complex configurations.

Prebid

Prebid offers high granularity and flexibility in setting floors for individual bidders, specific ad sizes, geographic regions, device types, and more. The Prebid Floor Module allows publishers to create detailed, nuanced pricing strategies tailored to each unique auction scenario.

Granularity extends to real-time adjustments and the ability to use external data feeds for setting floors dynamically, making it highly adaptable to rapidly changing market conditions and different types of inventory.

Impact on Header Bidding

Google Ad Manager

GAM’s floor pricing through UPR can impact header bidding by enforcing consistent floor prices for all bids passing through the GAM ecosystem, including header bidding requests. This can potentially influence how header bidding partners compete with Google’s demand.

However, GAM’s UPR may lack the same level of flexibility in dynamic bidding situations within header bidding, as it is not specifically designed for rapid, real-time adjustments that may occur within open auctions.

Prebid

Prebid’s floor pricing is specifically optimized for header bidding scenarios, providing more dynamic control and real-time responsiveness to market changes. By using Prebid’s Floor Module, publishers can maximize competition among header bidding partners, potentially driving up revenue by ensuring only the highest-value bids win.

Prebid’s granularity and ability to set dynamic floors for specific bidders in the header bidding stack means it can better respond to fluctuating demand and competitive bidding scenarios, enhancing the overall effectiveness of the header bidding strategy.

GAM Floor Prices vs. Prebid Floor Prices

Choosing between GAM and Prebid floor prices often depends on whether publishers prioritize uniform control and simplicity (GAM) or flexibility, dynamic adjustment, and independence (Prebid).

Note: many publishers find success using a combination of both, leveraging GAM’s baseline controls with Prebid’s dynamic flexibility to maximize revenue.

Scenarios where GAM floor prices work best

1. Unified control across multiple demand sources

Publishers who work with various demand partners may benefit from GAM’s UPR. This feature ensures consistent floor pricing across all demand sources, maintaining a standardized minimum price.

- Example. A publisher with substantial traffic across multiple countries who needs to enforce uniform minimum pricing for all bids coming through both Google and non-Google demand sources.

2. Baseline revenue protection

GAM’s static floor prices work well for publishers looking to establish a consistent baseline value for their inventory, especially if they prefer predictable revenue outcomes over maximizing short-term gains from market fluctuations.

- Example. A publisher of high-quality niche content that consistently attracts premium buyers may use static floor prices in GAM to maintain brand value and avoid underselling their impressions.

3. Simplified management through a single interface

Publishers seeking to streamline floor price management and reporting through a single interface may find GAM’s UPR interface easier to navigate compared to managing separate rules in Prebid.

- Example. Smaller publishers or those with limited technical resources who want a centralized solution to control floor prices across all sources.

4. Ensuring transparency and consistency in auctions

GAM’s UPR benefits publishers seeking transparency and consistent auction outcomes across their inventory, reducing concerns about preferential treatment for certain buyers.

- Example: Publishers looking to maximize trust with their demand partners by offering transparent pricing rules.

Scenarios where Prebid floor prices work best

1. Dynamic pricing based on real-time market conditions

Prebid’s dynamic floor prices allow for real-time adjustments based on changing demand and market conditions.

- Example. A news website experiencing high traffic during breaking news events can use dynamic floors to capitalize on increased demand for impressions.

2. Granular and flexible floor price control

Prebid offers more granular control over floor prices, enabling publishers to tailor minimum CPMs for specific ad units, device types, geo-locations, or even individual bidders.

- Example. A publisher who wants to differentiate floor prices for desktop and mobile users or set different floors for various geographic regions can leverage Prebid’s flexibility.

3. Programmatic header bidding environments

Prebid is often used in programmatic header bidding setups, where multiple demand sources compete in real-time auctions. Publishers can use the price floor module to establish dynamic floors that optimize yield without manual intervention.

- Example. A publisher running a complex header bidding configuration with numerous demand partners may find Prebid’s capabilities essential for adjusting floors based on auction performance.

4. Customizable real-time data integration

Prebid supports integration with external data services to adjust floor prices dynamically based on factors such as seasonality, audience behavior, or real-time bidding data.

- Example. Publishers with access to detailed audience data can use it to inform dynamic floors, adapting prices based on the value of specific audience segments.

5. Independence from Google’s ecosystem

Publishers seeking greater independence from Google’s ecosystem may prefer using Prebid’s floor price mechanisms, especially if they want to prioritize non-Google demand sources.

- Example. A publisher concerned about preferential treatment for Google demand may use Prebid to ensure fair competition among all bidders

Common challenges with both GAM and Prebid floors

1. Overpricing inventory and reducing fill rates

Overpricing can lead to fewer bids and impressions being sold, reducing overall ad revenue. High floor prices deter advertisers who may find it cost-prohibitive to bid on inventory, which could lead to a decrease in fill rates and leave impressions unsold.

What to do?

Publishers should analyze market demand and historical data to establish optimal floor prices that do not deter buyers. Using price elasticity tests and A/B testing can help identify the point where raising floors maximizes revenue without significantly impacting demand.

2. Managing dynamic floors without causing revenue dips

Dynamic floor prices offer flexibility but can cause instability in revenue if not carefully managed. Sudden spikes or drops in floor prices may disrupt bidding behavior and lead to revenue dips if buyers pull back or face unexpected increases.

What to do?

Implement safeguards such as minimum and maximum floor thresholds to limit extreme changes in floor prices.

Use data analytics to monitor the performance impact of dynamic adjustments in real time, allowing for corrective measures if revenue starts to decline. Regular performance reviews, combined with input from demand partners, can help identify and mitigate issues before they lead to larger revenue impacts.

3. Maintaining consistency across different demand sources

When using both GAM and Prebid floors, there can be inconsistencies between the two systems, leading to confusion among demand partners and inefficiencies in auctions.

For example, Prebid’s dynamic floors may conflict with GAM’s static or UPR rules, potentially causing bidding discrepancies.

What to do?

Align floor pricing strategies across GAM and Prebid by creating a cohesive approach that accounts for each system’s unique characteristics.

For example, publishers can use GAM’s UPR for baseline pricing while leveraging Prebid’s dynamic module for real-time adjustments, ensuring consistent outcomes across all demand sources.

4. Complexity and technical overhead

Configuring and maintaining dynamic floors in Prebid requires technical expertise and resources. For smaller publishers or those without dedicated technical staff, this can pose a barrier to implementation.

What to do?

Publishers can use automation tools and seek support from ad tech partners or consultants to simplify the implementation and management of dynamic floors. Regular training and documentation are also beneficial for ensuring that in-house teams stay up-to-date with best practices.

5. Adapting to market changes and seasonality

Demand and CPMs fluctuate based on seasonality, market conditions, and user behavior. Static floors set in GAM may not keep pace with these changes, leading to missed revenue opportunities or overpricing.

What to do?

Implement a mix of static and dynamic floor pricing strategies. Use dynamic adjustments during periods of high demand or competitive bidding while maintaining static floors to provide consistent protection during lower-demand periods.

Best Practices for Setting Effective Floor Prices

Regularly analyze performance data

Review past performance metrics to identify trends in bid amounts, fill rates, and revenue. This analysis helps in setting floor prices that reflect the true market value of the inventory. Regularly updating these analyses ensures that floor prices remain aligned with current market conditions.

The digital advertising landscape is dynamic. Regularly monitor the performance of set floor prices and be prepared to adjust them in response to changes in demand, seasonality, or shifts in user behavior. Continuous optimization is key to maintaining an effective floor pricing strategy.

Test and adjust floor prices to find the optimal balance

Floor prices prevent ad impressions from being sold below a specific value, safeguarding the publisher’s revenue. However, setting them too high can deter advertisers, leading to unsold inventory and reduced overall earnings. Conversely, setting them too low may undervalue the inventory. Therefore, it’s essential to find an optimal balance.

Implement A/B testing to evaluate the impact of different floor price levels on fill rates and revenue. Experimenting with various strategies allows publishers to identify the most effective pricing models for their specific audience and inventory. Data-driven decision-making is essential for continuous improvement.

Segment inventory

Different segments of inventory may have varying values. Consider setting distinct floor prices based on criteria like:

- Ad placement. Premium placements (e.g., above-the-fold) may warrant higher floor prices.

- Device type. Mobile, desktop, and tablet users may have different engagement levels and advertiser demand.

- Geographic location. Users from certain regions may be more valuable to advertisers.

- Ad format and size. Rich media or larger ad units might attract higher bids.

Collaborate with demand partners

Engage with advertisers and DSPs to gain insights into their bidding behaviors and preferences. Understanding their perspectives can help in setting floor prices that are attractive to buyers while still meeting revenue goals.

Transparent communication builds stronger relationships and can lead to more favorable bidding environments.

Conclusion

Mastering floor price strategies is essential for publishers aiming to maximize revenue and inventory value. Understanding when and how to use each approach, or combining their strengths, allows publishers to adapt to market trends, avoid underselling inventory, and enhance auction competition.

Google Ad Manager offers centralized, consistent floor pricing through its Unified Pricing Rules. It’s perfect for publishers who prioritize predictable pricing across all demand sources.

On the other hand, Prebid’s price floors module excels in providing dynamic, real-time adjustments that fit specific market conditions, individual bidders, and inventory segments.

The right floor price strategy can prevent inventory undervaluation while ensuring healthy fill rates. With the right solution, publishers can achieve optimal monetization, balancing revenue maximization and inventory management.